(Photo Credit: Wendy)

Monday, November 9

Tuesday, November 10

Thursday, November 12

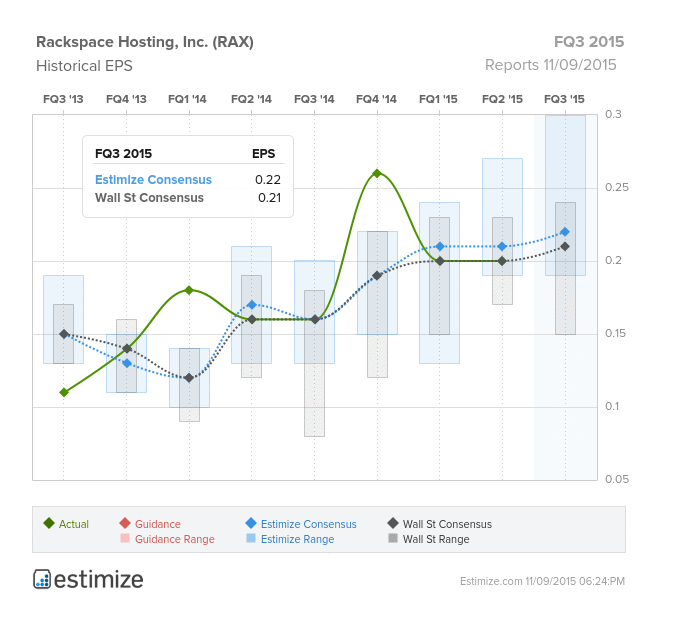

Rackspace Hosting (RAX)

Information Technology – Internet Software & Services | Reports November 9, after the close.

The Estimize community is looking for EPS of $0.22, only a penny better than Wall Street. Estimize is also looking for higher revenues of $504.44M vs. the Street’s $503.60M.

What to watch: Even though Rackspace is considered one of the first to get into the cloud industry, first movers advantage hasn’t helped this stock which has fallen nearly 42% since the beginning of the year. In order to differentiate itself in a very crowded market, RAX recently reorganized its business model to include computing and support. Behemoths such as Microsoft, IBM and Alphabet (Google) are all making a play for cloud computing, with Amazon really owning the space at this point, their Amazon Web Services makes up 25% of the market. Price competition has gotten incredibly stiff, with Rackspace still charging higher prices than its peers. To remain afloat Rackspace recently announced a partnership with Amazon, which still wasn’t enough to buoy the stock. At nearly 30 times forward earnings, a rich valuation doesn’t seem justified at this point given current fundamentals. Any improvement in share price this year relies on Q3 numbers coming in ahead of expectations.

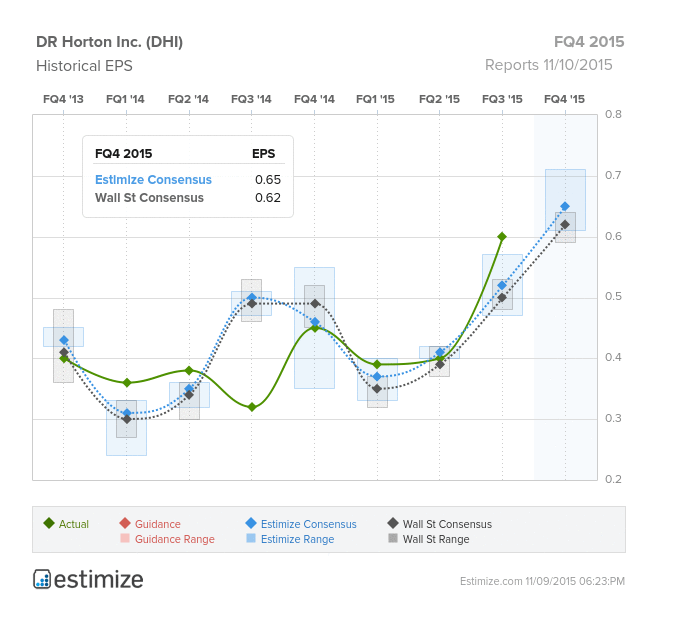

DR Horton (DHI)

Consumer Discretionary – Household Durables | Reports November 10, before the open.

The Estimize consensus calls for EPS of $0.65, three cents better than what Wall Street is looking for. Revenues are in-line at $3.055B.

What to expect: This week we get a read on the health of the US consumer and their willingness to purchase large ticket items such as homes when DR Horton reports. Housing had a robust summer season, with signs that that could potentially be breaking down. While Housing Starts came in much stronger than expected in September driven by a spike in multi-family units, that was offset by a decline in permits. New home sales also fell in September, and supply surged to 5.8 months from 4.9 months in August and 5.5 months in September last year. As the biggest home builder in the country, DHI is expected to benefit from a housing market that stayed strong in Q3. While it is exposed to nearly every US region, it has minimal exposure to Northeast which has been performing the worst and saw New Home Sales decline 62% in September. Overall investors should look for guidance around the housing market for the last quarter of the year when DR Horton reports tomorrow. A recent reading of Home Builders Sentiment showed continue confidence surrounding the strength of housing, coming in at 64 in October, up from 61 in September.

Leave A Comment