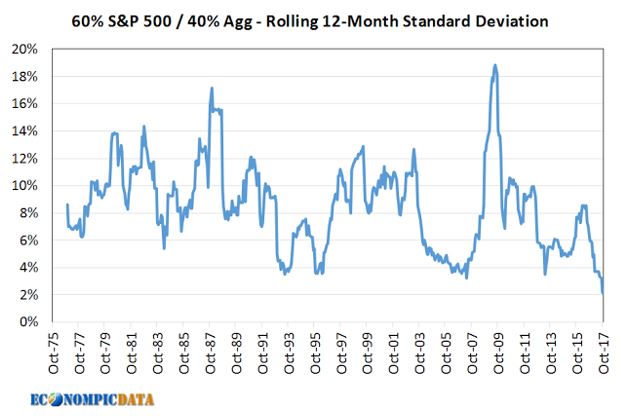

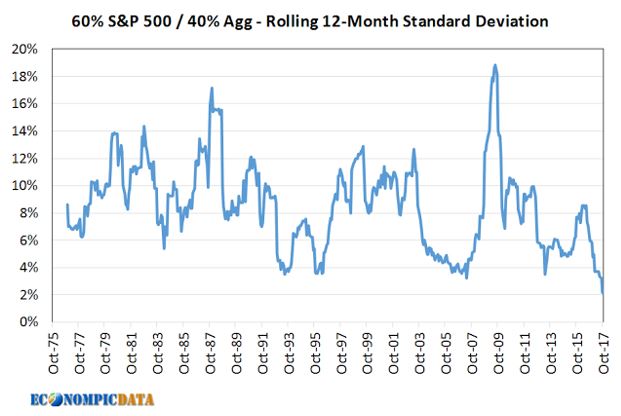

EconomPic had a an interesting article about the standard deviation of a 60/40 equity fixed income portfolio having imploded during the bull market and included a great chart for a visual idea of what has occurred.

While I doubt there are any surprises here as you can’t go more than a couple of scrolls on your Twitter feed without seeing something about how low VIX is, it nonetheless raises some good talking points.

The first thing is capital markets are like pendulums with a lot of things. Foreign equities dramatically outperformed domestic in the 2000’s, this decade domestic is way ahead of foreign until this year. Same thing with currencies, the dollar goes on long runs out outperformance followed by long periods of underperformance and so on. Where volatility has been low and headed lower this year it will at some point turn around and move higher. That is not a prediction that I am trying to game so much as an observation of how markets work and a reminder for practice management, take the time to remind clients that market cycles and volatility have not been repealed.

To that point, John Hussman’s latest commentary is a doozy. He says that based on his study of valuations versus interest rates and a few other things he believes that a 64% decline is coming to the S&P 500 with the expectation that the next 10-12 years will offer negative returns.

If you know who John Hussman is, you know that he has been bearish all the way up. The way I always mention him is to say he does a great job of framing the bear case and that is what he is doing; valuations are out of whack given where interest rates are. He hasn’t really drawn the correct conclusion in that he positioned against the market rising and his flagship fund has suffered for it.

If you accept that cycles have not been repealed then you realize that one day Hussman, Jimmy Rogers, and Marc Faber will be correct with one of their respective “markets are gonna crash” calls. This is why investors need the introspection of understanding how good things have been in the market. No matter what you think is going on in the world with anything and for whatever reason you care to believe in, the US equity market has continued to march higher. Maybe that means you’ve been holding your nose while staying long the market, but the market has often done what it shouldn’t and maybe that is what has happened for the entire bull market.

Leave A Comment