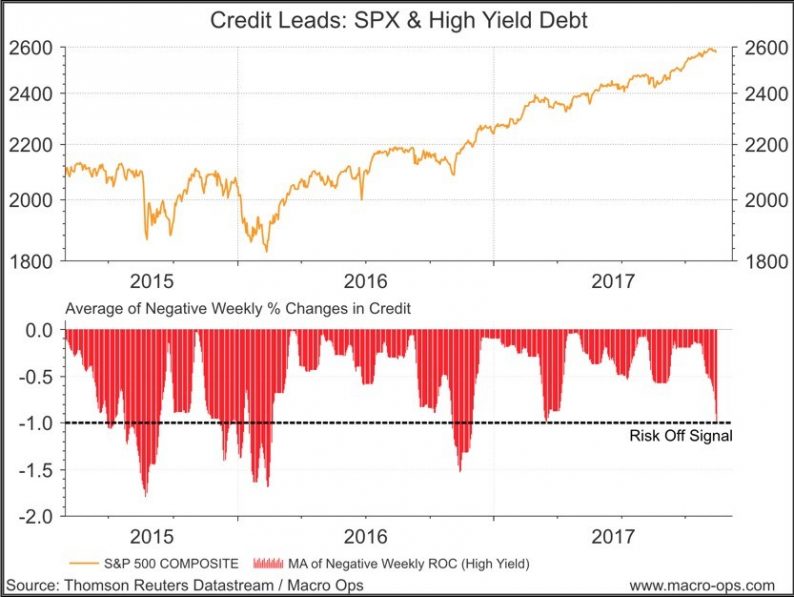

There’s some growing signs of weakness in this market. Breadth is slipping, credit doesn’t look too great, there’s more new lows versus new highs being made… that kind of stuff. I’m still not getting any major sell signals, except from my high-yield indicator. It flashed a signal today.

But there’s word the recent weakness in junk may be due to concerns over how deductions for debt and interest payments will be treated in the Republican tax reform plan. I don’t know. Either way, I’m not seeing any major red flags outside of junk bonds just yet.

I’m in “wait and see” mode, just “sitting on my hands” as Livermore would say. I’ve trimmed my book some but mostly because I want to free up capital for other trades that are lining up.

One of these trades is long dollar. I won’t expend much digital ink laying out my long dollar case, I’ve already done that plenty.

The skinny is that the market is underpricing the impact of tax reform, changing trade policies, and the coming normalization of the Treasuries balance sheet. These are bullish drivers for the dollar. I think the market will wake up to this in the coming months.

I’m already long the dollar through the yen pair. But I’m looking to also get long against the aussie and pound as well.

The technicals for the trades are setting up nicely. Take a look at this monthly chart of AUDUSD. Price has broken below a 15-year trendline and recently had a failed breakout to the upside.

Here’s the same chart on a weekly basis. You can see the bull trap failed breakout and now price is near the critical support line of its consolidation zone. The aussie is also plagued from a slowing China and a leveraged domestic housing market. A break below here would spell trouble for the pair.

Similarly, the pound has broken below a major 20+ year trading range shown on the monthly chart below.

Leave A Comment