The second quarter finished with a tricky question for markets. Did last week’s price action signal a significant change in tune or was it just insignificant noise in an unchanged trend of lower global long-term interest rates? One the one hand, it’s tempting for me to run a victory lap. Here I was musing about a steeper U.S. yield curve and outperformance in financials and energy. On that background the most recent price action has been a slam-dunk. On the other hand, I also said that I thought yields would fall over the summer, and that the reflation trade wouldn’t re-rear its head until Q3. So perhaps I shouldn’t raise my arms in celebration just yet. Bloomberg’s Guy Johnson probably was partly right when he said that:

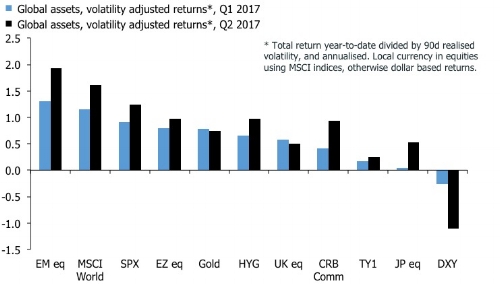

Last week’s swoon in bond yields and stock markets didn’t really change much in terms of the main stories. The chart below compares the volatility adjusted, and annualized, total returns of the main global assets markets in Q2, compared with their performance in Q1. Global equities continued to punch it in Q2, led by emerging markets but good ole’ Spoos and Eurozone benchmarks also did well. The annualized performance of Japanese equities also jumped, but it dipped in the U.K. Overall, the strong equity market performance in Q2 mainly was a result of a strong start to the quarter. Performance tailed off ominously in June.

Gold stayed in the top half of the distribution, but momentum—on an annualiZed basis—weakened. Elsewhere, the performance of US high yield and the headline CRB commodities index improved, although many commodity investors probably haven’t felt it given their overweight exposure to oil. In short, the headline CRB index rose because the dollar weakened. Speaking of which, the USD was once again stuck with the old maid, providing support for the contrarian axiom. Six months ago, everyone agreed that the dollar would be the star performer in 2017, but it’s fair to say that it hasn’t really worked out. Finally, despite all the talk about a flatter yield curve in the US, the long bond hasn’t exactly smashed it on a volatility-adjusted basis. The annualized total return of US bond futures improved in the second quarter, but it continues to trail most other asset classes.

Despite the fact that markets in Q2 appear to have been singing to the same hymn sheet as in Q1, I think it is fair to say that the latter part of the quarter confused investors. In times like these, I think it is useful to write out the questions that I find most difficult to answer.

Leave A Comment