It’s often said that the best way to make a small fortune in the oil business is to start with a large one. That old saw has certainly held true for the past couple of years. For most—but not all—of the oil sector. One corner of the business that’s done quite well has been refining. There you could have enjoyed a compound annual growth rate a third again better than that of the S&P 500.

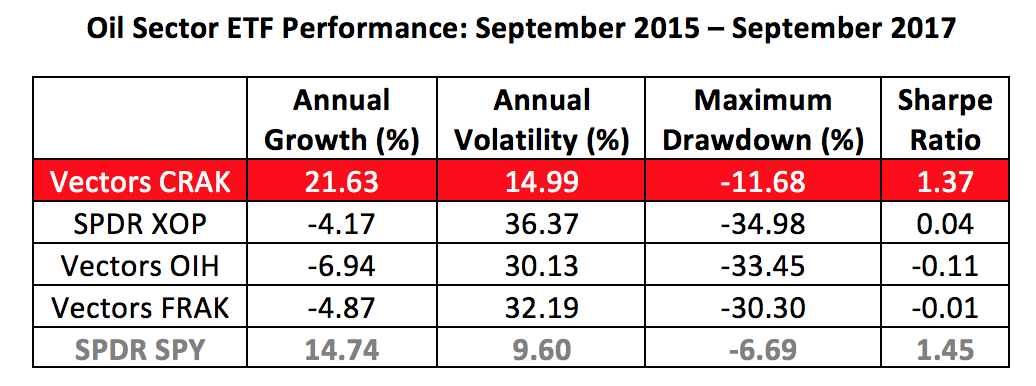

Who’da thunk? I mean, it was just a few years ago that integrated oil outfits were dumping their refining operations because of low margins. And now? Look at the performance of oil sector exchange-traded funds. All but the refiners would have cost you a small fortune over the past couple of years.

The VanEck Vectors Oil Refiners ETF (NYSE Arca: CRAK) tracks an index of global oil outfits that derive at least half of their revenue from refining. U.S firms make up a third of the CRAK portfolio with the likes of Phillips 66 (NYSE: PSX), Valero Energy Corp. (NYSE: VLO) and Marathon Petroleum Corp. (NYSE: MPC) at the top of the list.

The U.S. exploration and production segment is represented by the SPDR S&P Oil & Gas Exploration & Production ETF (NYSE Arca: XOP). The VanEck Oil Services ETF (NYSE Amex: OIH) tracks an index of 25 large companies that manufacture or supply goods used for the production of oil and gas. Fracking and other novel means of exploration and production are proxied by the VanEck Vectors Unconventional Oil & Gas ETF (NYSE Arca: FRAK).

CRAK has been quietly, but relentlessly, advancing to a $29 technical price objective set last year. It’s about $2 away. But there’s a seasonal trade in the domestic oil market that could propel the ETF’s U.S. components to even greater gains. It’s the crack spread.

The spread is the difference between crude oil input costs and the sale proceeds of distillate products such as gasoline and fuel oils. The spread widens with great regularity from October to February of the following year. In other words, the price of fuels gets increasingly higher relative to that of crude over the holiday season. In this case, the holidays at the season’s margins are Halloween and Presidents’ Day.

Leave A Comment