from the St Louis Fed

Emerging technologies are expected to significantly change the banking industry. But not every bank will adopt changes at the same rate. Some will adopt quickly, some much later, and some not at all.

To get an idea of how quickly banks may adopt such new technologies – commonly referred to as “fintech” – members of the St. Louis Fed’s Supervision division examined how quickly banks adopted websites. As they wrote, “If the past is prologue, this may foretell how technological innovations in banking will be diffused in the future.”

Economist Drew Dahl, Senior Economist Andrew Meyer, and Senior Coordinator Neil Wiggins noted that 1999 was when banks were first required to disclose whether they had URLs. That year, about 35 percent of banks reported having a website.

The table below shows that banks with websites in 1999 tended to be larger and located in urban areas.

Banks That Did Not Report Having URLs

Bank Adoptions of Websites

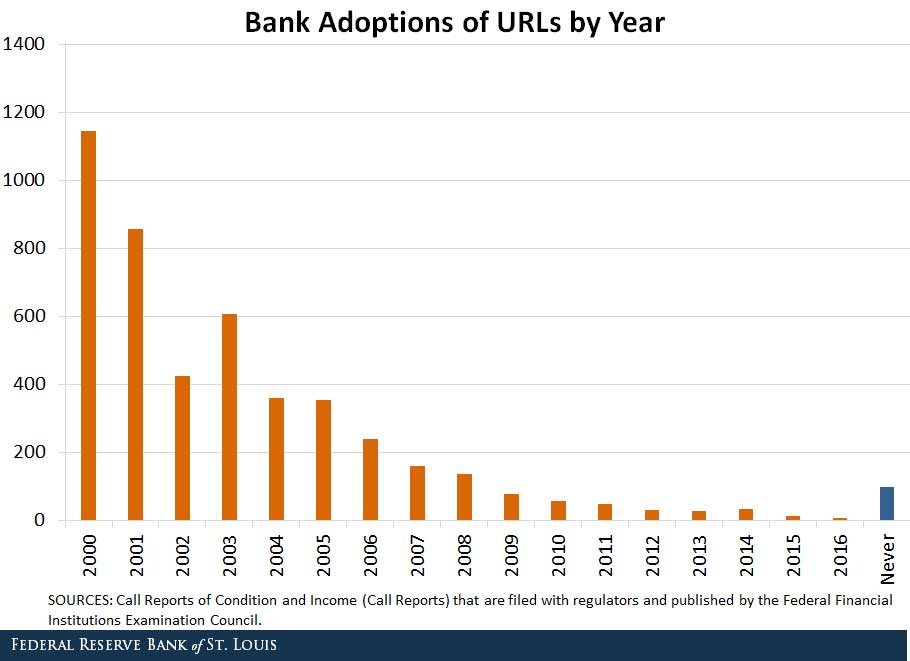

The authors noted that banks adopted websites rather quickly, with the majority having done so by 2001, as seen in the figure below.

The authors also noted other characteristics of banks and when they adopted websites:

Leave A Comment