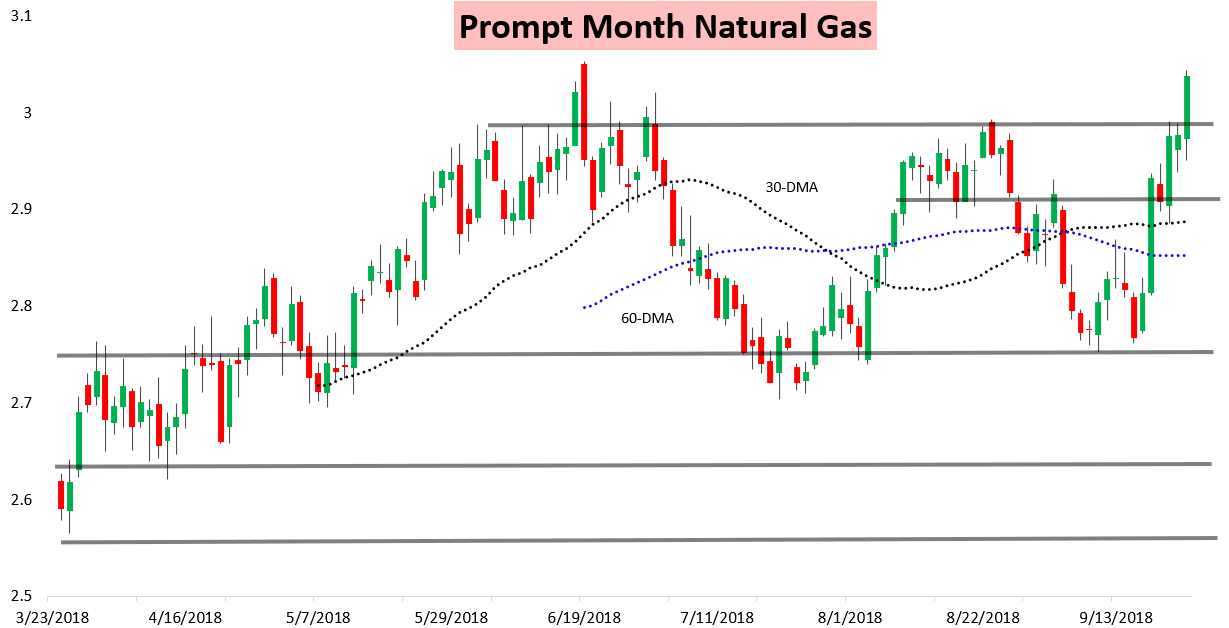

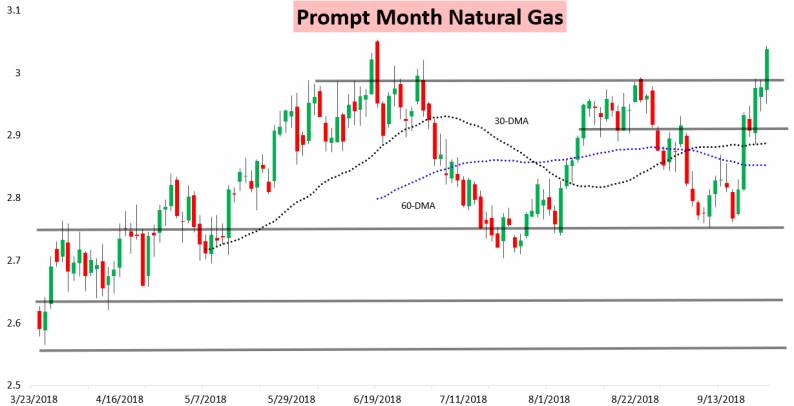

The October natural gas contract appeared to break out higher today, overcoming resistance from $2.98-$3.

The October contract led the way higher today as well, as it continues to see strength from strong Henry Hub cash prices ahead of its Wednesday expiry.

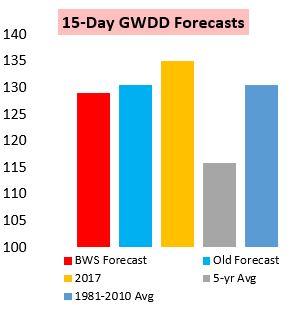

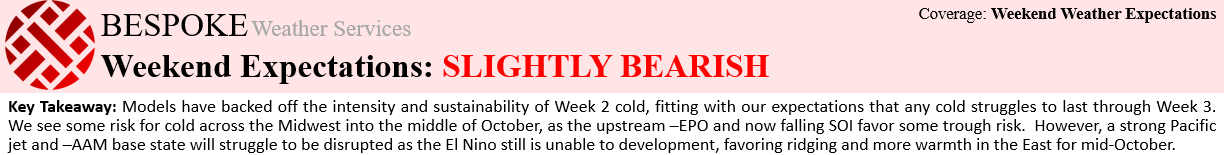

These gains came despite forecasts for the next two weeks that did not hold quite as much heating demand as they did last Friday.

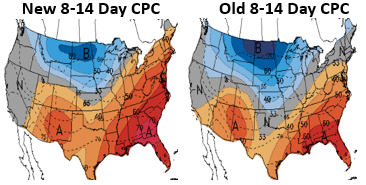

Over the weekend models warmed the South and East more through the first week of October, fitting expectations from our Pre-Close Update last Friday.

Climate Prediction Center forecasts this afternoon showed how warmth was more likely Week 2 across the East compared to previous forecasts, confirming our analysis.

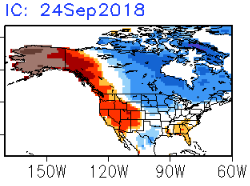

However, we noticed other trends over the weekend and again today on guidance that indicate a variable, shifting pattern making some of last week’s analysis out of date. The Pacific is providing a number of signs on how the pattern across the US could develop from here. The latest CFSv2 climate model forecast for October shows more cold risks now.

Natural gas balances have also been volatile and a major driver of price recently.

Leave A Comment