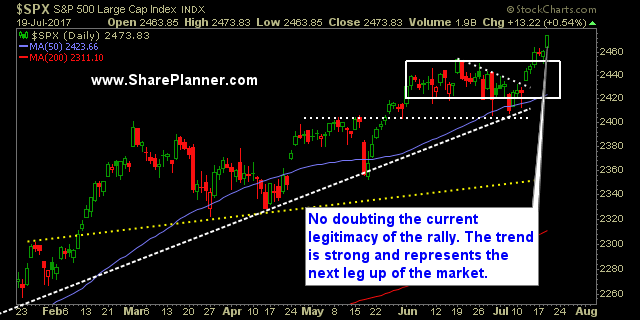

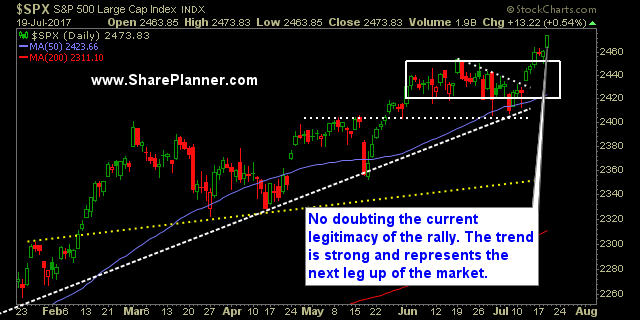

Now we are rallying – patience pays.

Who knows how long this rally can last for us, but the market required us to stay patient through all of June and some of July, to finally get a solid sizable rally that we could trade off of. And the market rewarded those with patience by rallying 7 of the last 9 trading sessions and out of the Darvas box we had been stuck in, to new all-time highs.

Now the key to this is recognizing it is impossible to know how long and how high this market can go. There are tons of people out there that will claim they know, and I’m here to tell you that they don’t. They are all guesses and not even educated ones at that. What you have to do as a trader is to manage the risk throughout. Raise the stop losses along the way, book gains in stocks that have run out of steam. If this market was to die out today, you want to make sure you are going to walk away with the majority of the gains.

If the market rallies 10% from here, great, let’s jump on the party wagon and take the ride up, but always be prepared for the opposite happening. You are not forfeiting your ability to make future profits, but you just aren’t going into it blind like most other traders are.

The market does have sell-offs, and while that hasn’t been the case at all since the Brexit, eventually it will, and while these rallies are nice, and you should take advantage of them as much as you can, you still want to be raising your stops and making sure that you aren’t leaving those profits open to getting wiped out in one big sell-off.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance:

Recent Stock Trade Notables:

Leave A Comment