By Mark Melin

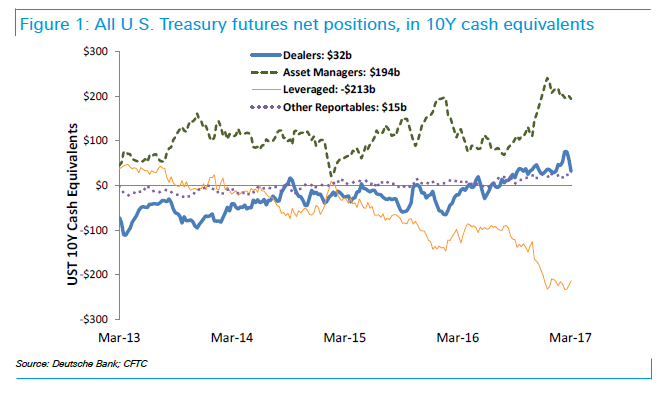

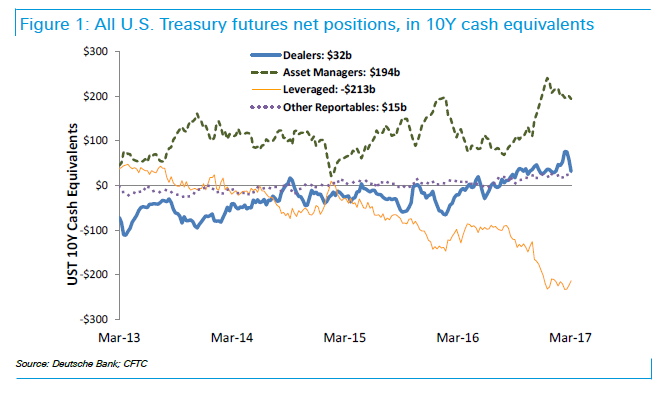

With the Ten Year US Treasury note touching the lower end of the “Trump election” range at 2.31%, a Deutsche Bank report analyzing Commodity Futures Trading Commission’s Commitment of Traders (COT) report shows speculative interests positioned for a move in the opposite direction. While interest rates were important — particularly given a weak US jobs report Friday — these same “specs” decreased their short exposures in the euro currency – especially Eurodollar futures– ahead of interesting electoral developments in the region.

Eurodollar futures – Certain professional traders caught on the wrong side of a bad US jobs number

It has been three weeks running that professional commodity futures speculators have reduced their net short exposure to the US Ten Year note, Deutsche Bank’s Dominic Konstam, Alex Li, Daniel Sorid and Steven Zeng point out. Spec net positions were lightened up by 192,000, last week, while adding to their record net shorts in Eurodollar futures. ValueWalk previously reported how various institutional research services were advising a position reversal in the trade.

In Eurodollar futures the record net short position, with an additional 47,000 contracts added on the week, now represents 25% of the total open interest in the market.

While it is difficult if not impossible to extrapolate individual speculator’s exact portfolio positioning from the report, as a whole there seems to be a relative value opinion emerging on long-term interest rates in the US relative to short-term rates in Europe.

With headline inflation expected to rise in Europe – and the European Central Bank potentially looking to pull interest rates out of the gutter as US rate hikes appear on an aggressive path – there is a more aggressive path identified in the US. This comes even after the surprisingly negative March jobs numbers.

Leave A Comment