There is a remarkable amount of empirical evidence that suggests that stock spin-offs tend to outperform the market averages in the years following the spin-off. Interestingly, this trend is sometimes seen in both the parent company and the daughter company.

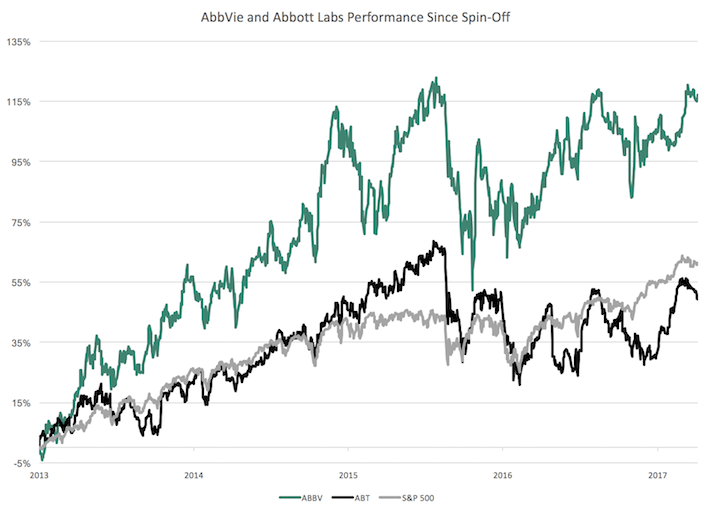

In 2013, AbbVie (ABBV) was spun-off from Abbott Laboratories (ABT). Since the spin-off, AbbVie has materially outperformed the broader stock market as measured by the S&P 500 Index.

Source: Yahoo! Finance

Despite this remarkable run-up, AbbVie has not become overvalued thanks to strong underlying earnings growth. AbbVie looks like an attractive investment right now. The company (along with Abbott) was ranked as a top 10 stock using The 8 Rules of Dividend Investing in the most recent Sure Dividend Newsletter.

AbbVie has now been an independent entity for more than four years. This article will analyze the investment prospects of AbbVie in detail.

Business Overview

Since being spun-off from Abbott Laboratories, AbbVie operates in only one core segment – pharmaceuticals. This exposes AbbVie to more risk than some other healthcare companies, who often diversify into the medical devices or consumer health subsectors.

AbbVie is a leader in the pharmaceutical industry, with a market capitalization of $105 billion, ~28,000 employees, 21 research and manufacturing facilities around the globe, and products that treat 30 million patients in 170+ countries.

AbbVie targets five main sectors of the global pharmaceutical market: oncology, immunology, neuroscience, virology, and focused investments. These segments are outlined in more detail below.

Source: AbbVie Presentation at the J.P. Morgan Healthcare Conference, slide 5

AbbVie’s stock has outperformed the S&P 500 since its spin-off in 2013. The performance of AbbVie’s security has been driven by the performance of AbbVie’s business. Between 2013 and 2016, AbbVie grew its adjusted earnings-per-share from $3.14 to $4.82, which is an increase of 15.3% per year.

Source: AbbVie Presentation at the J.P. Morgan Healthcare Conference, slide 4

AbbVie is also a rewarding stock from a dividend perspective. While the current AbbVie has only existed since 2013, it benefits from the dividend history of its predecessor – Abbott Laboratories.

Because of this, both AbbVie and Abbott are included in the Dividend Aristocrats index – a group of companies with 25+ years of consecutive dividend increases.

Leave A Comment