AT40 = 16.3% of stocks are trading above their respective 40-day moving averages (DMAs) – 3rd day of oversold period following 4-day oversold period

AT200 = 33.6% of stocks are trading above their respective 200DMAs

VIX = 19.9

Short-term Trading Call: bullish

Commentary

Friday was a day with a head-spinning mix of reassuring and ominous signals. Some important stocks lost big and/or suffered ominous fades. Some indices continued nasty slides or suffered new breakdowns. Two very important stocks delivered somewhat reassuring gains.

In the end, the S&P 500 (SPY) ended the day flat. AT40 (T2108), the percentage of stocks trading above their 40-day moving averages (DMAs), closed with a small gain after fading intraday from the oversold threshold (20%). AT200 (T2107), the percentage of stocks trading above their 200DMAs, closed with a small loss after fading from a downtrend line.

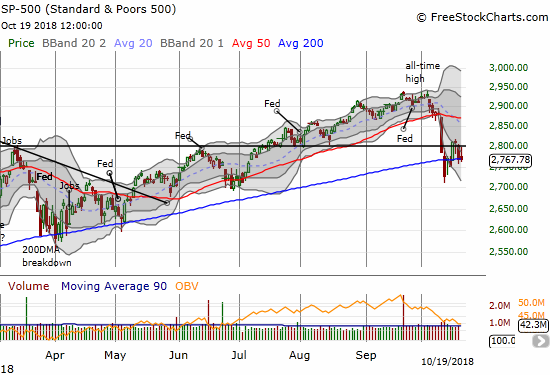

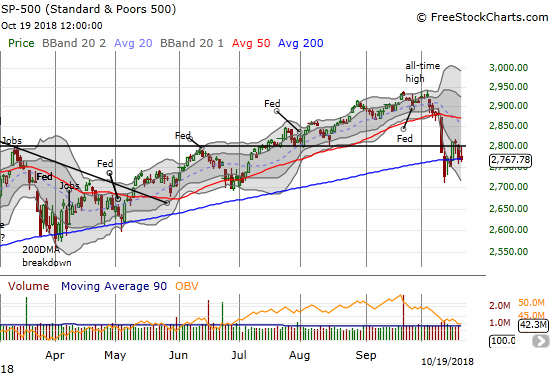

The computers and their technically-oriented programmers seem to be in control of the trading action. For the second straight trading day, the S&P 500 (SPY) managed to close exactly on top of its 200-day moving average (DMA).

The S&P 500 (SPY) lost of all of one point in what is becoming a clear pivot around its 200DMA.

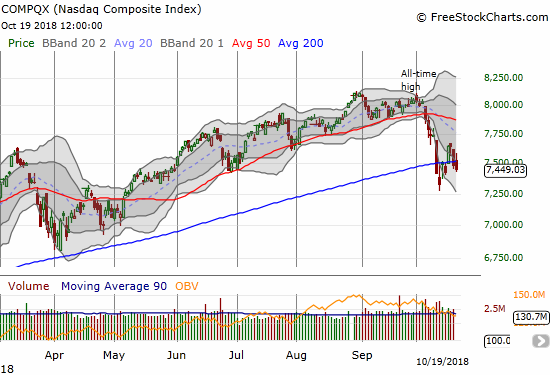

It is always good to see the S&P 500 holding critical long-term support. The NASDAQ was not so fortunate. After early gains, the tech-laden index faded to close under its 200DMA for the second straight day. At least the NASDAQ is still well off its recent lows. The Invesco QQQ Trust (QQQ) faded but closed flat and above 200DMA support.

The NASDAQ put its recent low back into play with a second straight close below its 200DMA.

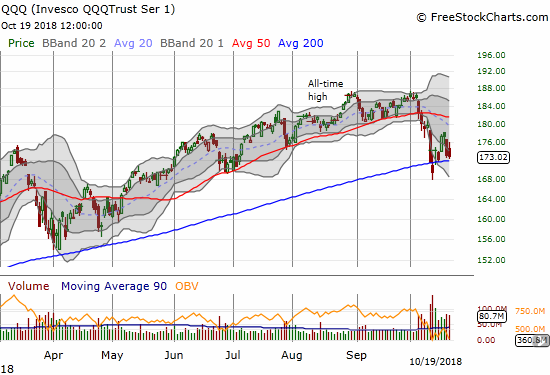

The Invesco QQQ Trust (QQQ) ended the day flat after a fade from intraday highs. Support at its 200DMA is still intact.

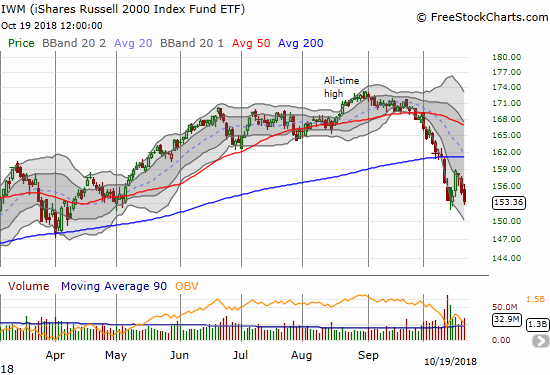

Small-caps were a locus of selling again as the iShares Russell 2000 ETF (IWM) faded from a gain to a 1.1% loss. The close finished a reversal of Tuesday’s promising gain. The close all kept intact tight resistance from the upper bound of the lower Bollinger Band (BB) channel.

The iShares Russell 2000 ETF (IWM) lost 1.1% and just barely made a new 7-month closing low.

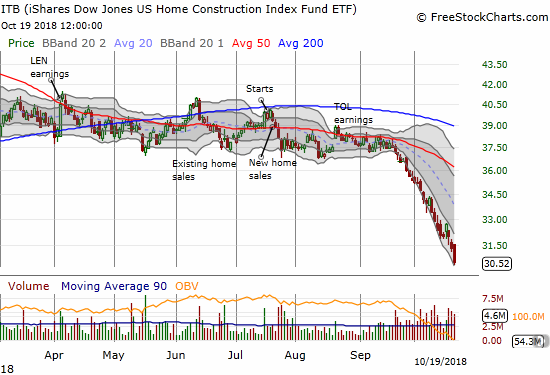

Home builders suffered mightily again with a 2.6% loss for iShares US Home Construction ETF (ITB). Since housing matters a lot more to more Americans than the stock market, I think the bear market in these stocks should be a much hotter topic of discussion and debate.

The iShares US Home Construction ETF (ITB) lost a whopping 2.6% to close at a 20-month low. The selling pressure continues to be relentless.

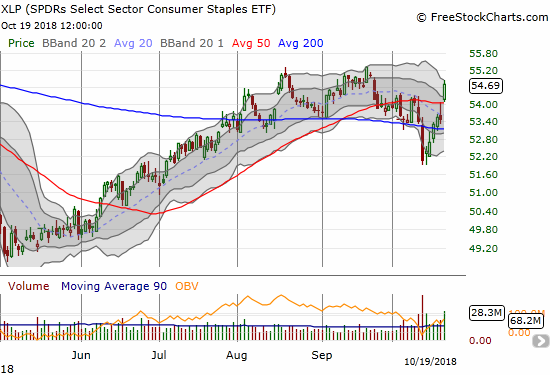

The market delivered a resounding applause for earnings from Proctor and Gamble (PG). PG gained a healthy 8.8% and closed at a 9-month high. This rally and breakout was enough to push the Consumer Staples Select Sector SPDR ETF (XLP) to a 2.3% gain. I took this opportunity to take small profits on my XLP call options. I am a bit skeptical of the prospects for XLP to break out above the recent highs in the short-term. More importantly, the risk/reward for holding out for more gains through a potential cycle of churn did not look attractive.

The Consumer Staples Select Sector SPDR ETF (XLP) gained 2.3% on a 50DMA breakout.

The volatility index, the VIX, signaled a market stalemate by ranging from high to low within the previous trading day’s high and low and closing the day down less than 1%.

Leave A Comment