AT40 = 59.4% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 59.9% of stocks are trading above their respective 200DMAs

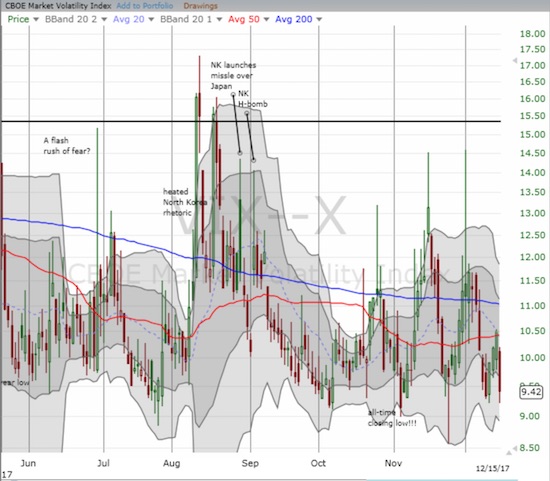

VIX = 9.4

Short-term Trading Call: cautiously bullish

Commentary

The market fatigue I pointed out last week lasted just one more day. In the spirit of this relentless bull market, the dip was ever so shallow and ever so brief. Moreover, it was just enough of a pause to refresh the buying spirit of traders and investors. The S&P 500 (SPY), Nasdaq, and the PowerShares QQQ ETF (QQQ) all benefited with new all-time highs.

The S&P 500 (SPY) jumped to another all-time high on extremely high volume.

The NASDAQ jumped to another all-time high on extremely high volume.

The PowerShares QQQ ETF (QQQ) finished invalidating the swoon from 2-3 weeks ago. Volume also jumped although it has been higher in recent months.

AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), affirmed the swift switch back to bullish affinities with a surge from 51.2% to 59.5%. AT40 rallied to as high as 62.6%. The volatility index, the VIX, added its confirmation by plunging 10.2% to 9.4. For reference, recall that the VIX hit an all-time closing low of 9.1 on November 3, 2017. I promptly doubled down on my call options on ProShares Ultra VIX Short-Term Futures (UVXY) for what I now think is an important hedge even if the periodic VIX surge is not actually around the corner.

The volatility index, the VIX, is starting to get very familiar with historically low levels.

I left my short-term trading call at cautiously bullish. I still want to see buyers push AT40 into overbought conditions before before getting fully on board. Until then, the market’s lack of breadth keeps me a bit wary.

The Perfect Bubble

Bitcoin and cryptocurrencies are all the rage now. Having lived through two massive financial bubbles, I have promised myself to stay out of this frenzy (or mostly anyway, until a friend drags me kicking and screaming into one of these 109, yes ONE HUNDRED AND NINE AND COUNTING, newfangled coins). Yet, I cannot help enjoying some of the commentary. The tweet below from Nassim Taleb of “Black Swan” fame, and the subsequent responses, helps reveal why and how fans of Bitcoin and other cryptocurrencies have helped to create the “perfect” bubble.

Leave A Comment