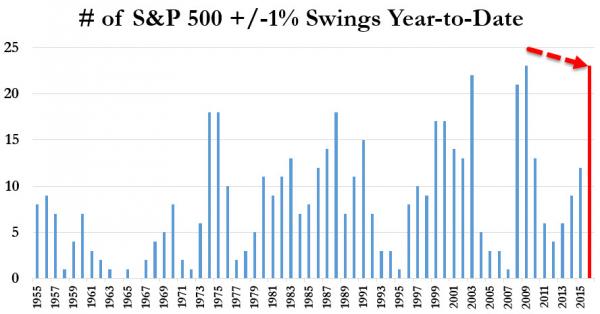

It is different this time. So far in 2016, there has been 23 days where the S&P 500 has moved +/- 1%. To put that in context, in the last 60 years, no other year has started off with such volatility.

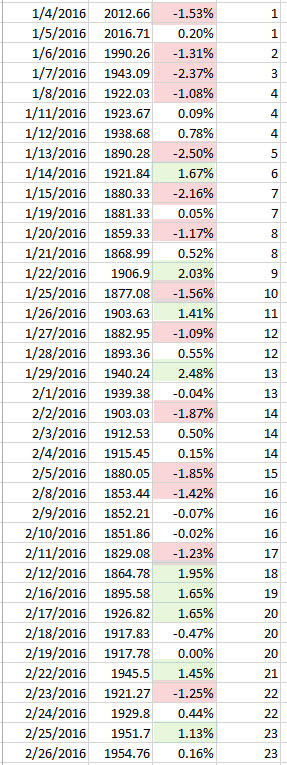

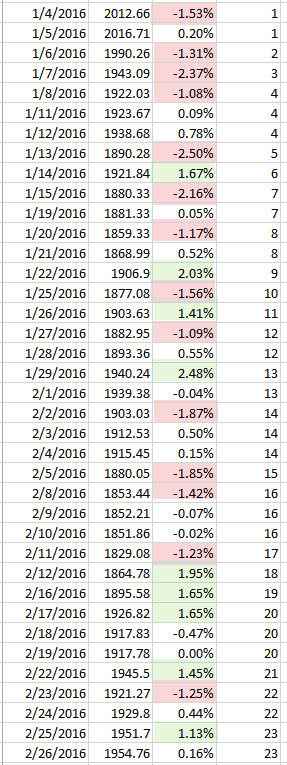

2016 has been busy…

2016 is now the “most volatile” year on record…

And for those wondering about VIX in context – S&P Implied Vol just dropped back to its historical volatility, which is picking up once again.

When the market is swinging around at this rate, does the risk-reward really make sense for those buying dividend-stocks to be “paid to wait” seems weak… and furthermore, most hedge funds will be forced to derisk amid this chaos (which perhaps explains the recent crash in equity market neutral funds).

Leave A Comment