In wrapping up last week’s missive we simply wrote: “As to what we see for Gold in the new week: not much.”

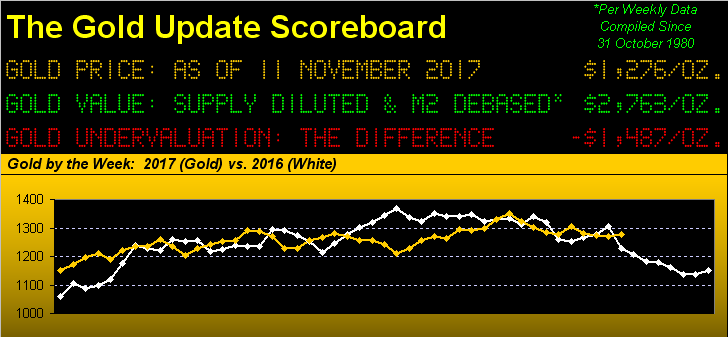

What did we get? Not much. Not that a net change for the week of 0% is nothing, given Gold’s having to endure a micro-crash yesterday (Friday) before settling out the week at 1276. ‘Twas the third consecutive week of Gold sporting a net change of less than 10 points. And over the last six weeks, which included a 27-point net gain that was then immediately mitigated by a 24-point net loss, one might stretch to say there’s been no net change whatsoever. So for the 18th of the 45 trading weeks year-to-date, again we find Gold having again finished inside of The Box (1280-1240) again.

Miss Gibbs? “Yes, sir?” Might you select any one of our recent articles, simply change its date to today, and post it? Doubtful anyone would be the wiser. “But you ought comment on the micro-crash.” Yes, Miss Gibbs. (She’s a winner).

And so here we go with nine minutes on Friday in the life of the COMEX December Gold futures contract. A 10-point drop in Gold is not that remarkable, but when it swiftly evolves on seven-times the usual volume for that time of day, one cannot help but wonder what may be afoot:

Now consider this: to trade 38,000 contracts requires “day margin” in an entity’s account of nearly $60 million, (and if held “overnight”, some $205 million). Such an account size surpasses even that of Squire’s.

“Don’t look at me, mmb…”

Now just stay with me, Squire. As each Gold contract “controls” 100 ounces, ’twas essentially a sale approaching some 4,000,000 ounces, i.e. around $5 billion worth. That’s a “hedgie-wedgie”, and if for no other reason than window-dressing, ’twas deliberately Gold depressing. Still, back in crept the buyers, giving credibility to the supportive stance of The Box (1280-1240) as bordered by the purple lines in our below chart of Gold’s weekly bars from a year ago-to-date, the parabolic Short trend now three weeks in duration:

Leave A Comment