In last week’s “Technically Speaking” post I discussed the S&P 500 hitting 2700 by Christmas. To wit:

“As stated in the title, the current push higher puts 2700 in sight by the time Santa fills the ‘stockings hung by the chimney with care.’

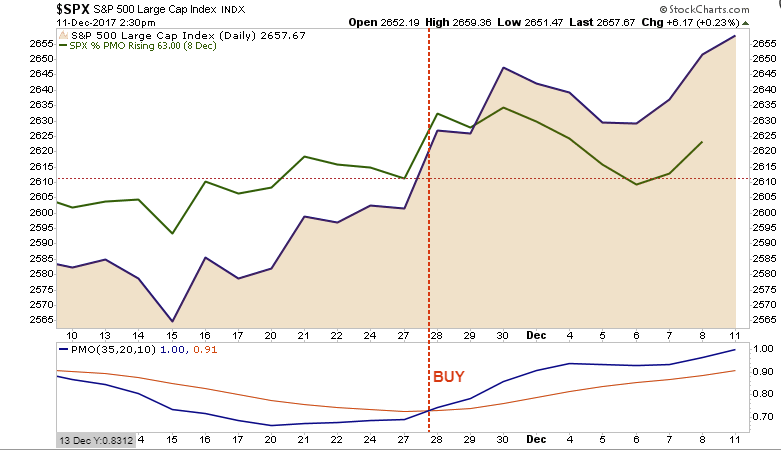

As shown below, price momentum triggered a short-term “buy” signal following Thanksgiving, and after the brief ‘AMT Tax Debacle’ in the Senate Tax Bill, momentum again has turned up as prices continue to press higher.”

As noted above, this “momentum” keeps portfolios allocated towards equity risk, but we continue to be prudent about the risk we are taking and continue to hedge risk as necessary.

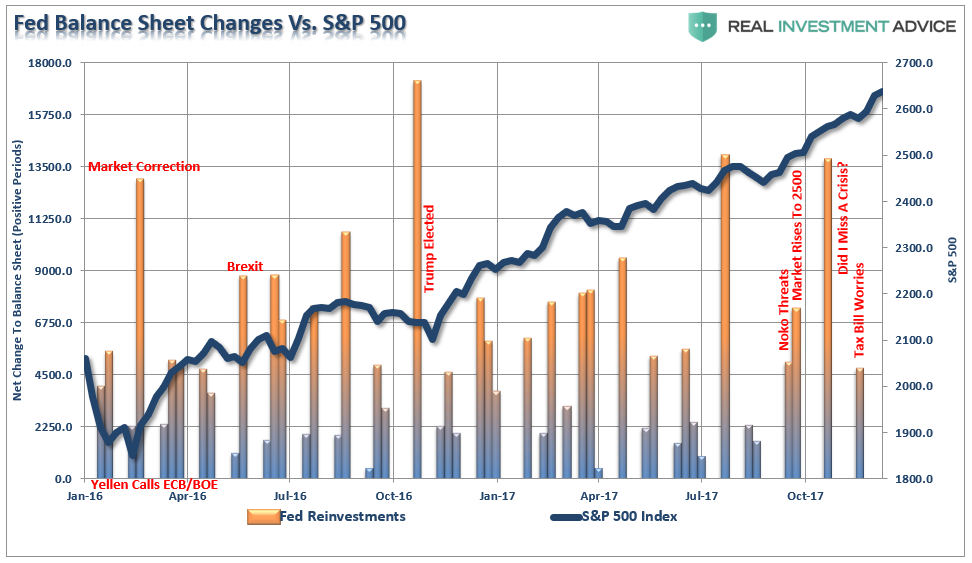

After discussing that “dip” in the market caused by concerns over the current “tax reform” proposal, I followed up with an analysis of the Federal Reserve’s balance sheet manipulations. Unsurprisingly, I discovered the following:

“With global Central Banks still flooding the system with liquidity, the Fed has yet to begin rolling off their reinvestments as expected. In fact, the Fed made a timely reinvestment during the “Senate Tax Bill” debacle earlier this month.”

Of course, that bump of liquidity sent asset prices rocketing higher.

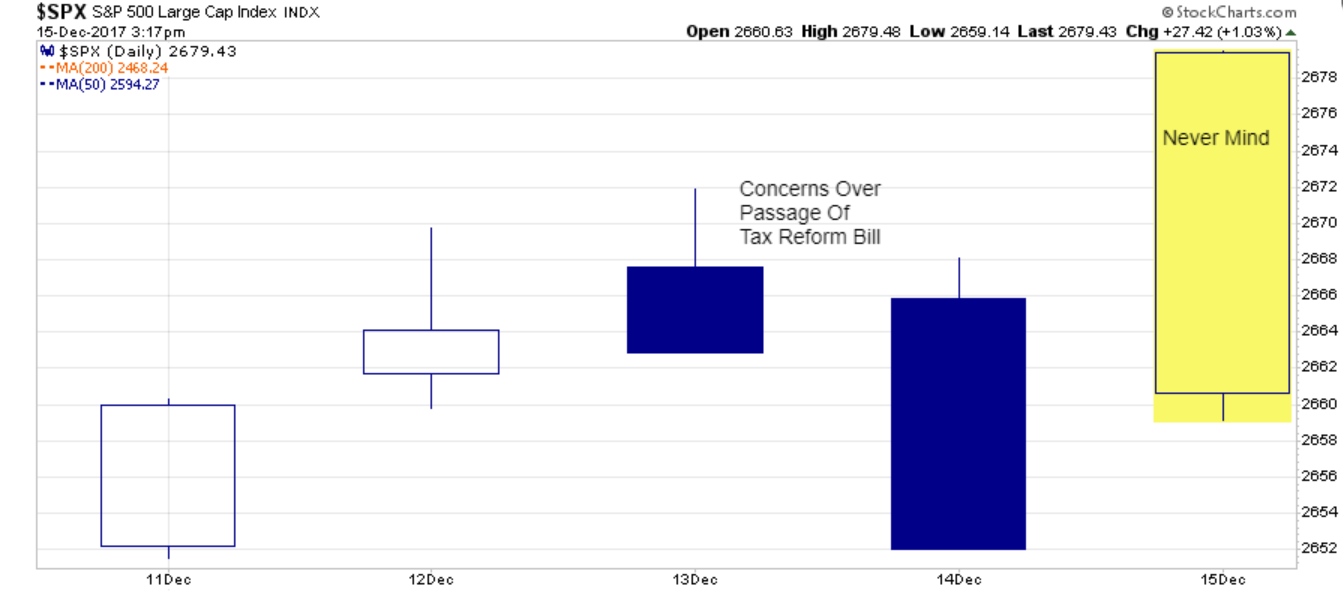

Then on Thursday, we saw a brief slide in equities as concerns once again rose over the potential for the tax reform legislation to be blocked by several Senators who were leaning towards voting “no” on the bill. However, those concerns lasted only momentarily and stocks rocketed higher on Friday ending the week on a positive note. With concerns over tax reform fading, equities are sitting at all-time highs and within striking distance of 2700 by Christmas.

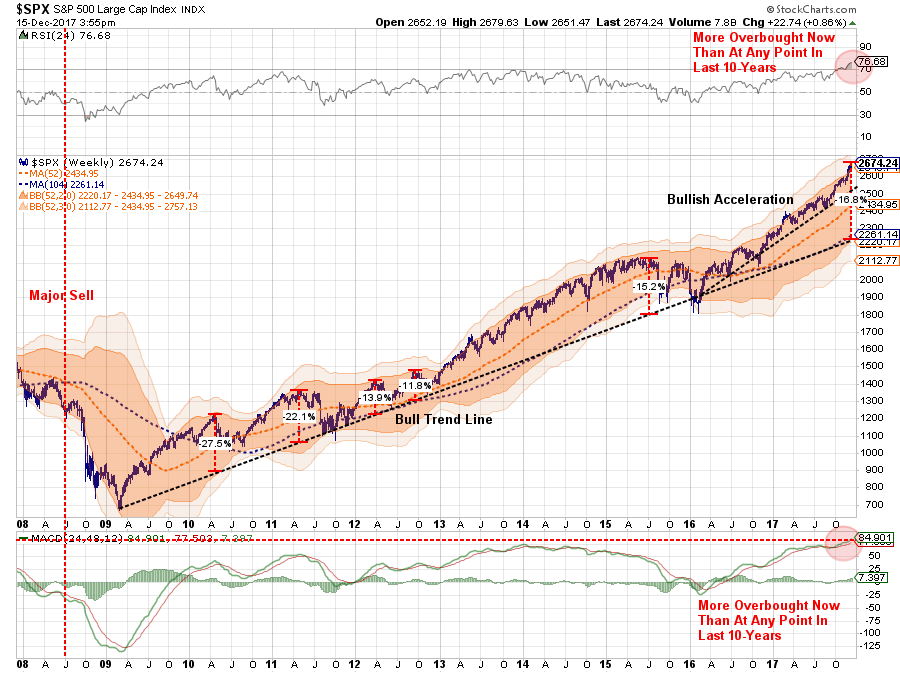

The current technical underpinnings remain bullish currently, but as shown below, are pushing into extremely overbought conditions. The chart below shows the 1 and 2-year moving averages with 2 and 3-standard deviations of the 1-year moving average. That deviation, combined with the most overbought readings on both RSI and MACD, suggest risk has risen markedly in recent weeks.

While the conditions are very bullish heading into the end of the year, it is advisable that individuals take some actions in re-balancing risk in portfolios. As I noted last week in “The Exit Problem,” it is time to start considering sitting a little closer to the “exit.” To wit:

“Am I sounding an ‘alarm bell’ and calling for the end of the known world? Should you be buying ammo and food? Of course, not.

However, I am suggesting that remaining fully invested in the financial markets without a thorough understanding of your ‘risk exposure’ will likely not have the desired end result you have been promised.

As I stated often, my job is to participate in the markets while keeping a measured approach to capital preservation. Since it is considered ‘bearish’ to point out the potential ‘risks’ that could lead to rapid capital destruction; then I guess you can call me a ‘bear.’

Just make sure you understand I am still in ‘theater,’ I am just moving much closer to the ‘exit.’”

What does that mean? Here are the rules once again which guide the investment process in our shop. It is through following these basic rules that, with the markets overbought, underlying fundamentals stretched, we continue to suggest some portfolio actions be taken to reduce, not eliminate, overall risk.

- Tighten up stop-loss levels to current support levels for each position.

- Hedge portfolios against major market declines.

- Take profits in positions that have been big winners

- Sell laggards and losers

- Raise cash and rebalance portfolios to target weightings.

Notice, nothing in there says “sell everything and go to cash.”

However, being a bit more cautious at this juncture will likely pay dividends. As I have stated over the past several weeks, if tax reform does pass, it now looks likely that it will become effective in February, 2018. If that is the case, the setup for an early January/February sell-off in the markets is likely as portfolio managers lock in gains. While I have NOT added a short position to portfolios as of yet, the setup by year end is becoming much better with the excessive price extension in the market.

Leave A Comment