I always enjoy reading John Stepek’s work at MoneyWeek. Just recently he addressed the question of where are we in the current market cycle. To wit:

“In his latest memo to clients, [Howard Marks] outlines his basic philosophy and how it affects Oaktree’s investment process at the moment. Marks’ basic point – which appears pretty self-evident, though you’d be surprised by how many people try to deny it – is that markets move in cycles.

The tricky part is trying to work out when the cycle is going to turn.”

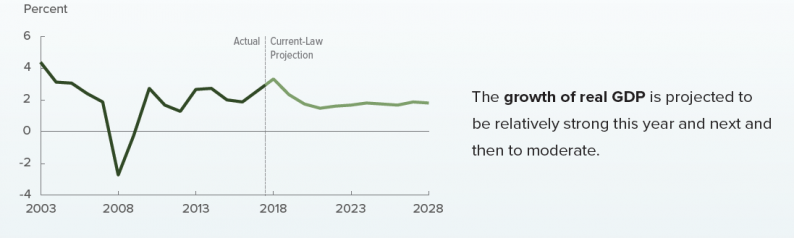

This is a fascinating point as it is not just individuals who try and deny that markets, and the economy, move in cycles but also the Federal Reserve and Government agencies. As I noted last week, the Congressional Budget Office is currently estimating the next 10-years of growth in the economy at a steady 2%.

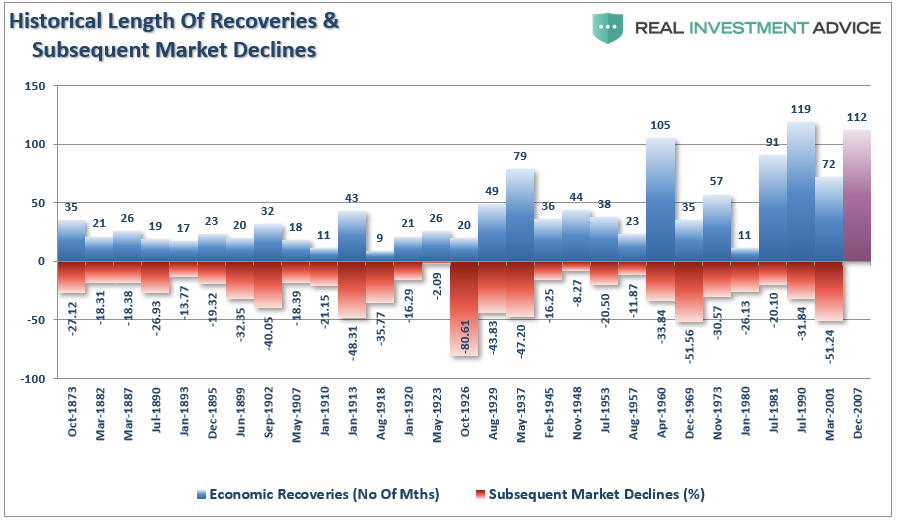

Given this is already approaching the longest economic growth cycle in history, at the lowest rate of growth, and with the Federal Reserve hiking rates, it is highly unlikely the economy will remain “recession free” for another decade. It is also important to note the CBO didn’t predict the recessions in 2001-2002 or in 2008. In fact, in 2000 the CBO predicted the U.S. would be running a $1 Trillion surplus by 2010. They were only off by $2 Trillion when 2010 finally rolled around.

What is clear is that both markets and the economy do not only cycle, but cycle together.

However, knowing when these cycles will occur isn’t that simple. As John notes:

“Of course, it’s not that simple. You might know that winter is coming; you’ll also know when it’s here. But can that knowledge tell you when the first snow will fall – or if it will fall at all?

And there’s your problem right there. Markets might be cyclical but timing them is almost impossible. You might know that the equivalent of an asset-market winter is coming. But you don’t know when it will hit and you don’t know how severe it will be.

So – to put it bluntly – what is the use of a theory of market cycles if it can’t tell you when to invest and when to pull out?”

That is absolutely correct. But it also the same analysis given for valuations.

Just like market and economic cycles, valuations are a horrible “timing” indicator. But like cycles, valuations are simply an indication of expected returns in the future.

As Marks noted there is no magic formula, or timing device, that can tell you “go to cash now” or “go all in today”. However, it is quite obvious that when valuations are elevated, and interest rates are rising, taking on excessive portfolio risk will have a very low future return.

Leave A Comment