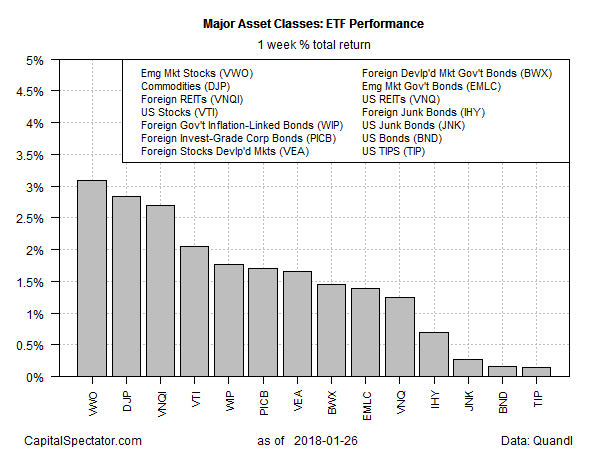

It was a clean sweep. Every one of the major asset classes posted an increase last week, based on a set of exchange-traded products. The gains, a sign of heightened optimism, mark the first across-the-board advances on a calendar-week basis since last November.

Emerging-markets stocks topped the winner’s list for a second week in a row. Vanguard FTSE Emerging Markets (VWO) was up a sizzling 3.1% for the five trading days through Jan. 26, reaching another record high. The latest jump marks the ETF’s eighth consecutive weekly gain. A key factor in the emerging markets rally is the slide in the US dollar, which fell to a three-year low at last week’s close, based on the US Dollar Index.

The weakest gain for the major asset classes last week: US inflation-indexed Treasuries. The iShares TIPS Bond (TIP) inched up 0.2%, the fund’s first weekly increase so far in 2018.

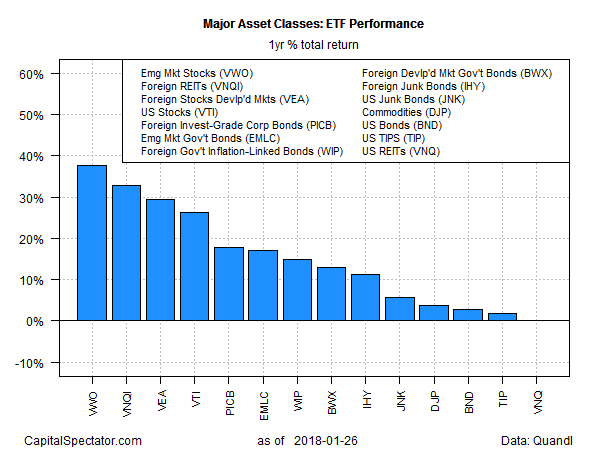

There’s also a noticeable lack of red ink for the one-year trend. Once again, emerging-markets stocks are at the top of the list. VWO’s currently posting a 37.6% total return for the 12 months through last week’s close. The second-place performance is in foreign real estate via Vanguard Global ex-US Real Estate (VNQI), which is higher by 32.8% for the trailing one-year window after factoring in dividends.

At the opposite end of the one-year performance ledger: US real estate investment trusts (REITs). Vanguard REIT (VNQ) is unchanged for its one-year total return.

Given the strong upside momentum that’s prevailed in markets recently, it’s no surprise to find that most drawdowns are at or near zero, as of last week’s close. Five of the 14 major asset classes currently enjoy no drawdown vs. their previous peaks; another six are posting mild drawdowns below 2%. Just three asset classes suffer drawdowns of any magnitude: US REITs (VNQ), emerging market bonds (EMLC), and broadly defined commodities via DJP, which leads the field at the moment with the steepest peak-to-trough decline: a hefty 44% drawdown.

Leave A Comment