At first glance you might very well think Advanced Micro Devices (AMD) is having a hugely successful rebirth. Here is two-year chart of the semiconductor company’s stock price:

After so many fits and starts and promises over the last few decades, with little to show for it in the way of sustainable profitability, I had not really looked closely at the shares, even during this huge run recently. Then I read an article in the July issue of Fortune that spotlighted AMD’s bet on new chips that apparently has gotten investors’ attention.

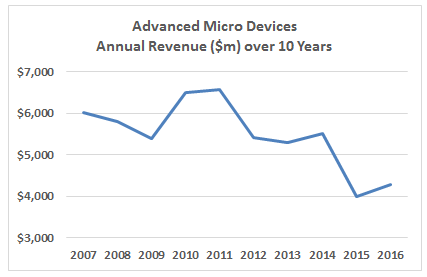

For a company whose annual revenue in 2015 and 2016 ($3.99 billion and $4.27 billion, respectively) were the lowest out of any of the past ten years, AMD’s current market value of $13.5 billion (today’s share price: $14.39) seemed pretty lofty, but I wanted to dig deeper to see if progress is really being made. The numbers are pretty ugly:

The aforementioned revenue trend is poor:

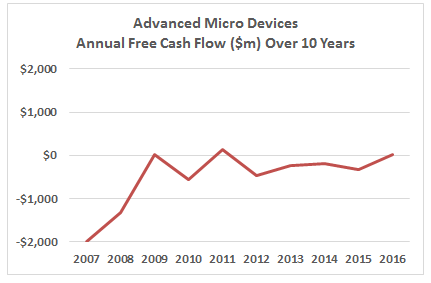

And profitability is hard to come by. Here is free cash flow over the last decade:

Okay, “hard to come by” might be overly generous… AMD has not turned a material cash profit, after required capital expenditures, in any of the past 10 years. Looking at the two-year stock price chart again, it is hard to understand why the share are trading above $14 each.

Evidently, optimism about future products is high, despite some clear setbacks as noted in the Fortune piece. But I suspect the stock may be ahead of those rosy expectations. Including half a billion dollars of net debt, investors are currently valuing AMD at $14 billion. Revenue is expected to reach $5.3 billion in 2018 (sell side consensus estimate), which would get the company back to 2012-2014 sales levels.

So what is a best case for AMD? I decided to try and pinpoint a number in order to draw a final conclusion about the current stock market valuation. To do this I like to assume that most metrics get back to previous peak levels and see what kind of stock price I would get if things go right from here. Call it the “bull case” as many analysts do.

Leave A Comment