This is probably one of the more interesting times in recent memory for the stock market.Investors are so panicked about the possibility of a recession, bear market, or even just a simple correction that they are exiting funds at a breakneck pace.

Bank of America fund flow data showed that $44 billion has exited stock-focused ETFs and mutual funds over the last five weeks.This is the largest period of redemptions since August 2011, which should tell you something about sentiment and perceived direction.Take a look at the complete workup on fund flows by Barbara Kollmeyer of Marketwatch.

Knowing nothing more than that data, you would probably think that we are 10-15% off the highs right now. Yet somehow, the SPDR S&P 500 ETF (SPY) is less than 3% below its all-time peak.

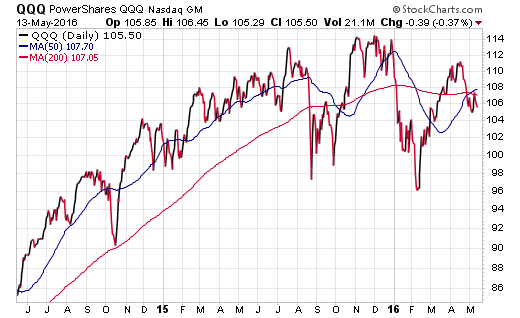

I see where all the pessimism comes from and can relate to this skittish drift.Just take a look at the PowerShares QQQ (QQQ), which tracks the NASDAQ-100 Index. QQQ has been unable to recapture its 2015 highs and is back below its 200-day moving average.This technology and consumer discretionary heavy index has been steadily weakening over the last four weeks.

Want to hear more bad news? Financial stocks have been awful all year. The retail sector got absolutely slammed last week on a slew of earnings misses. Transportation stocks have had a difficult time during the month of May and biotech is a complete disaster as well. There just isn’t much to love about this kind of price action.

Furthermore, we are seeing bond yields on the 10-Year Treasury Note Yield (TNX) stair step lower as investors flock to the perceived safety of high quality fixed-income.You don’t have to be a market technician to see that 1.70% on the 10-Year is a pretty important level and a big breakdown here would likely be driven by additional selling in risk assets.

The whisper is that foreign buyers are gobbling up Treasuries as comparative yields look amazing when compared to the negative rates in Europe and Japan.I can’t argue with that logic.

Leave A Comment