Rumors of AAPL’s demise have once again been greatly exaggerated. Moments ago, Apple reported Q1 earnings which not only beat on the top and bottom line, but also showed a record number of iPhone shipments in the quarter at a record 78.4 million, 2 million more than expected, and at higher ASPs. Earnings of $3.36 were higher than the $3.22 expected, on record revenue of $78.4 billion, above the $77.3 BN expected.

The result in a nutshell:

The only fly in the ointment appears to have been a modest cut to

guidance, as it now expects to generate Q2 revenue of $51.5BN to

$53.5BN, beow the $53.8BN expected.

In an interview, Apple CFO Luca Maestri said that app store sales increased 40% y/y in the quarter. Apple also provided the following guidance for its fiscal 2017 second quarter:

Tim cook was happy:

“We’re thrilled to report that our holiday quarter results generated Apple’s highest quarterly revenue ever, and broke multiple records along the way. We sold more iPhones than ever before and set all-time revenue records for iPhone, Services, Mac and Apple Watch,” said Tim Cook, Apple’s CEO. “Revenue from Services grew strongly over last year, led by record customer activity on the App Store, and we are very excited about the products in our pipeline.”

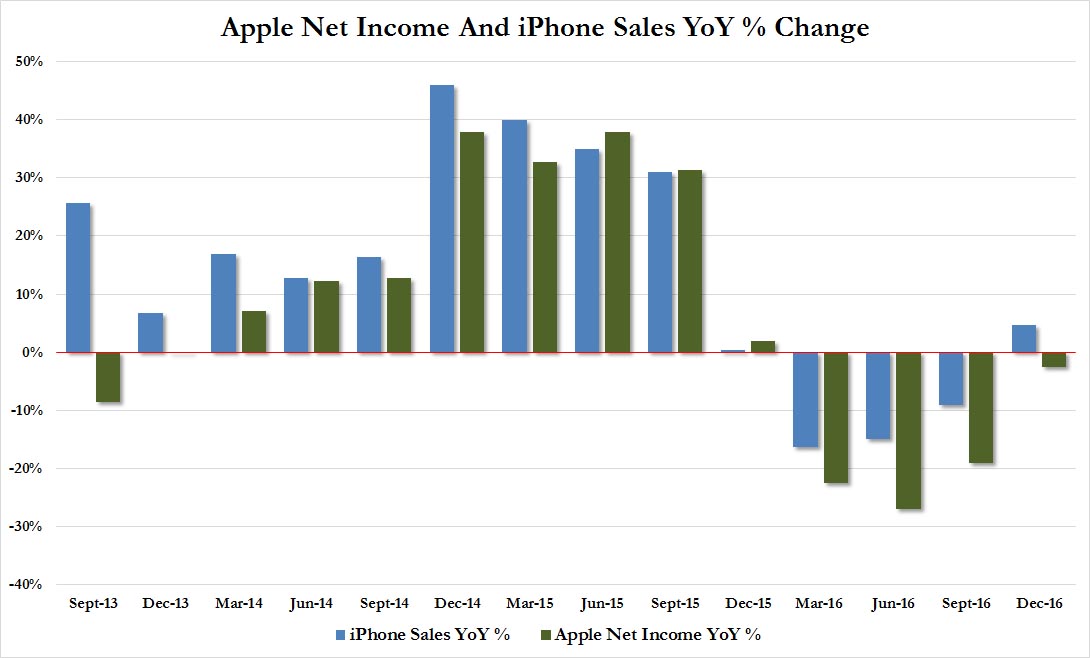

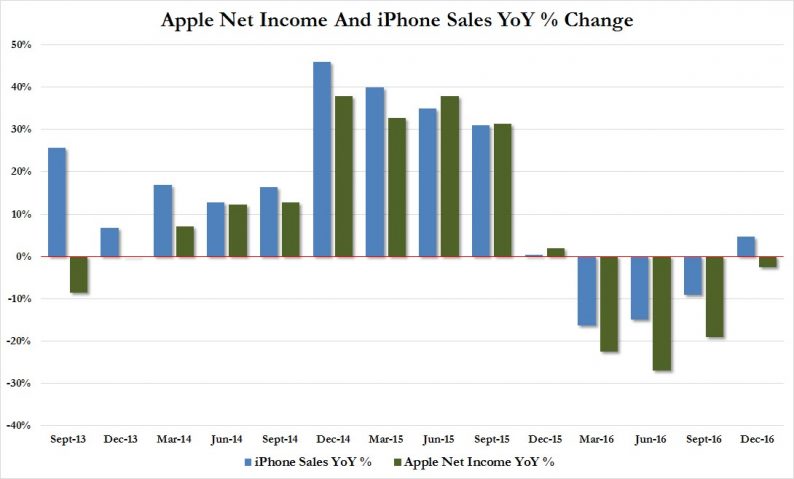

The result in chart format:

While Apple revenue grew Y/Y, Net Income failed to rise from a year ago, dipping fractionally by 2.6% even as iPhone sales rose by 5% from a year ago.

Q1 Revenue of $78.4 billion was an all time high.

Leave A Comment