In this article, we will look at what drives stock prices: valuations and earnings. Anytime we discuss monetary policy or the economy, we are doing so with the intention of figuring out how valuations and earnings will be affected. As you probably are aware of from our articles, the US stock market is doing well compared to the rest of the world. China is leading emerging markets lower. This has led to an extraordinary divergence between American valuations and the valuations of international equities.

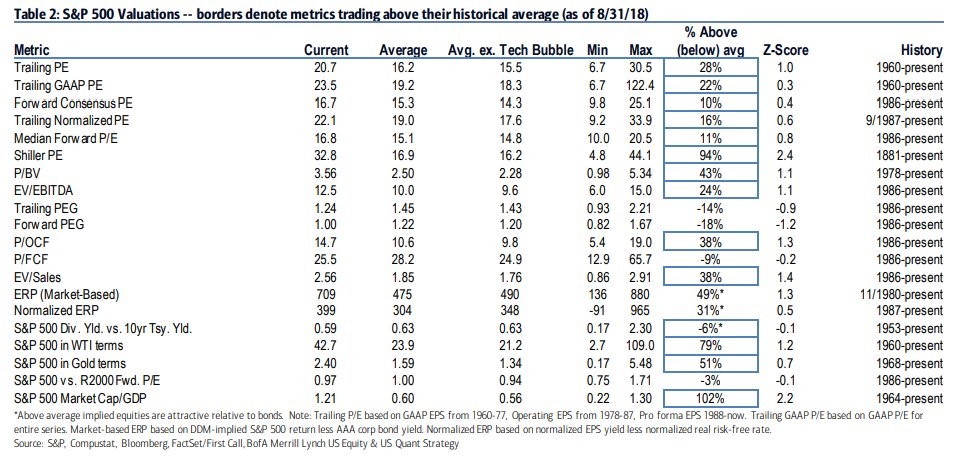

As you can see from the chart below, the price to book value of US stocks versus the price to book value of the MSCI all-country world index excluding America is at a record high.

Source: Merrill Lynch

American stocks always have higher valuations because of the country’s strong economic fundamentals such as free markets, a stable political system, and decent demographics compared to other developed markets such as Europe and Japan. America is home to the world’s largest tech firms which have high multiples, but also high growth.

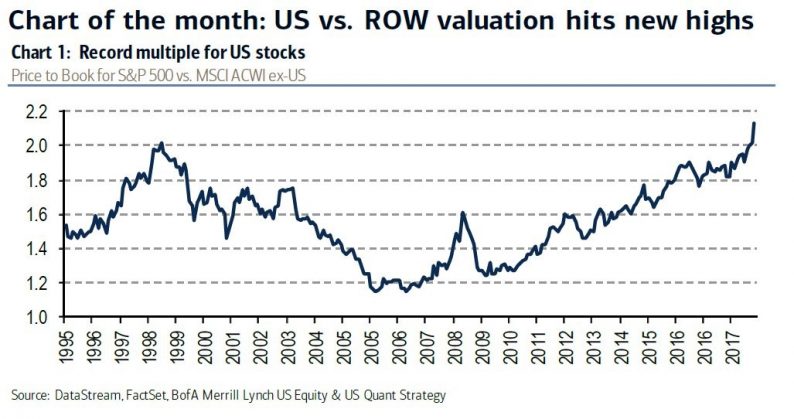

14 Out Of 20 Metrics Say U.S. Stocks Are Expensive

There’s strong justification for America to have above average valuations, but it’s more difficult to defend record valuations in relation to the rest of the world. The best defense of U.S. stocks might be that the price to book value is a flawed valuation tool. If you believe that and don’t like comparing America to the rest of the world, you can review the table below.

Source: Merrill Lynch

14 of the 20 valuation metrics above state the S&P 500 is expensive. There have been similar results for a while, but stocks keep moving higher. That’s because the economy and earnings are growing. We need to see earnings growth disappointments and eventually a decline in earnings to see stocks fall.

Weak Earnings Preannouncements

If you are trying to determine where earnings are headed, it’s important to review earnings pre-announcements. The pre-announcements for Q3 2018 earnings haven’t been great. The best way to describe them is tepid because there haven’t been many so far. As you can see from the FactSet chart below, 76% of firms have issued negative guidance.

Leave A Comment