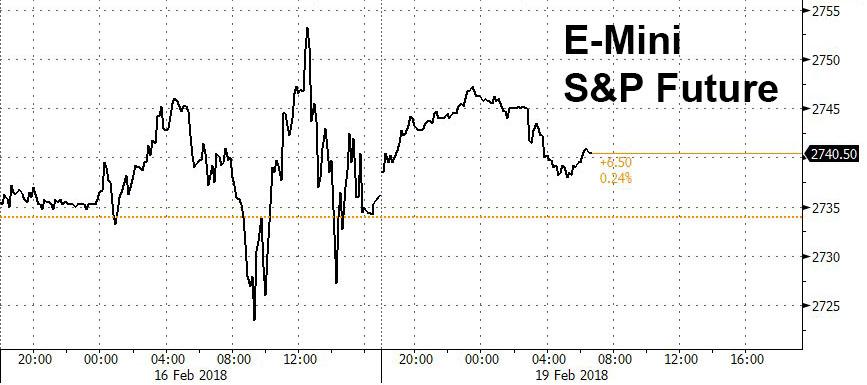

With the US on holiday for President’s Day and many Asia markets still closed for Lunar New Year holidays, it has been a quiet start to the week, even as last week’s dollar turbulence has resumed, while S&P futures are doing their best to levitate without anyone manning the controls.

World stocks were set for a sixth session of gains on Monday, extending a recovery from a selloff sparked by fears of creeping inflation and higher borrowing costs.

The MSCI world index rose 0.1% in Monday trading. The index has recovered nearly half of its losses from late January to last week’s low, posting a gain of 4.3% last week. That was its best weekly performance since December 2011.

“Market confidence often attracts even more market confidence, and that is what we are seeing at the moment,” said CMC Markets’ David Madden. “The cooling of the volatility index (VIX) has given some dealers the green light to buy back into the stock market, and while the fear factor keeps sliding, it is likely equity benchmarks will continue to push higher.”

Asian stocks rose for the 6th consecutive day, with Japan and South Korea sharaes advancing in holiday-thinned trade as the MSCI Asia Pacific index rose as much as 0.8% before trimming gains to 0.35%. Japan’s Topix rose as much as 2% after Japan’s exports beat estimate.

European shares struggled to carry forward last week’s momentum after rebounding from a selloff with their biggest weekly gain in 14 months. The Stoxx Europe 600 Index dipped -0.2% after erasing modest opening gains amid disappointing earnings reports, while a strong euro capped potential gains among European exporters.

In company specific news, Reckitt Benckiser fell -5% after posting its first-ever year of stagnant sales. Daimler sank -2% after US investigators said they are looking into whether the company used illegal software to cheat emissions tests on diesel vehicles in the US. Reports suggest the existence of documents indicating that one software function on Daimler diesel vehicles turned off the car’s emissions control system after driving just 26 km. Swiss Re rose on news Softbank was seeking to join the company’s board to influence how the reinsurer manages its $160BN in investments. Discussion is centred on a deal where Softbank would become an anchor shareholder in the company with a 20% to 30% stake while gaining multiple seats on the board. European steel companies including ArcelorMittal, Outokumpu and Tenaris climbed after Friday’s U.S. commerce department revealed recommendations to impose tariffs or quotas on imports of aluminum and steel, and China said it reserves the right to retaliate.

The dollar swung around from losses to gains and back to losses; the yen retreat from a 15-month high even as data showed Japan’s exports and imports grew strongly in January from a year earlier in a sign the economy continues to expand. As a result, the USDJPY rebounded as intraday traders who sold earlier, bought back after the Nikkei 225 closed 2 percent higher, boosting risk sentiment. The Bloomberg Dollar Spot Index recouped early losses as the greenback’s gains vs yen helped offset its decline against the Aussie and kiwi which were buoyed by commodity prices.

The U.S. currency has been weighed down by a barrage of factors, including worries about widening U.S. trade and budget deficits and speculation Washington might pursue a weak dollar strategy. There is also talk that foreign central banks may be reallocating their reserves out of the dollar.

Treasury futures were little changed while Australian sovereign bonds hold onto opening gains with 10-year yield four basis points lower. 10Y Treasuries yield closed at 2.87% on Friday, after rising to a four-year high of 2.944% last week. Treasuries are not trading Monday due to the holiday in the U.S.

Leave A Comment