For the second day in a row, Asian stocks were dragged lower by tech stocks and Apple suppliers, with the MSCI Asia Pacific Index down 0.2% led by Samsung Electronics and Taiwan Semiconductor Manufacturing in response to the previously noted report that Apple will slash Q1 sales forecasts for iPhone X sales by 40% from 50 million to 30 million. Most Asian equity benchmarks in the region fell except those in China. European stocks were mixed in a quiet session while U.S. equity futures are little changed as markets reopen after the Christmas holiday.

Away from Asia, stocks remained closed across the large European markets, as well as in parts of Asia including Australia, Hong Kong, Indonesia, the Philippines and New Zealand. Japanese benchmarks slipped from the highest levels since the early 1990s, helping to pull the MSCI Asia Pacific Index down, while shares in Dubai, Qatar and Russia were among the big losers in emerging markets. S&P 500 futures were flat as those for the Dow Jones slipped. The euro edged lower with the pound – although there were no reverberations from Monday’s odd flash crash which was only observed on Bloomberg feeds, while Reuters ignored it…

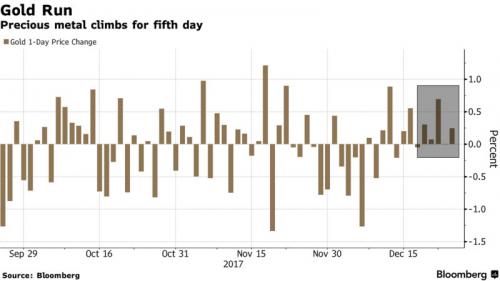

… while the Russian ruble, South African rand and South Korean won were the notable gainers. Gold extended its recent advance as silver also jumped.

In a continuation of Monday’s muted action, Apple’s Asian suppliers again responded to the biggest market news of the week and fell after Taiwan’s Economic Daily reported on Monday that Apple will slash its sales forecast for the iPhone X in the quarter to 30 million units, down from 50 million units originally. Some analysts have also flagged disappointing demand. U.S.-based JL Warren Capital is predicting shipments of just 25 million units as consumers baulk at the “high price point and a lack of interesting innovations”.”Our work continues to suggest the March and June quarters will have a significant amount of iPhone X make-up shipments,” Chicago-based Loop Capital said in a note last week, forecasting shipments of 40-45 million units in the first quarter of 2018, up from an estimated 30-35 million units in the current quarter. Analysts at Jefferies have also forecast around 40 million iPhone X sales for the first quarter.

Apple suppliers that were most hit included Genius Electronic Optical Co Ltd which dropped 2.4 percent on Tuesday to take its losses this week to 11.4 percent. Pegatron Corp also fell on both days, losing 3.2 percent this week.

Meanwhile, China stocks closed higher on Tuesday as an advance by construction machinery makers and financials offset a drop by consumer staples. Hong Kong’s markets will reopen on Wednesday after a two-day holiday break. The Shanghai Composite Index rose 0.8% to 3,306.13, its highest level since Dec. 11 while the blue-chip CSI 300 Index added 0.3%, erasing earlier drop of 0.7%.

Leave A Comment