Summary:

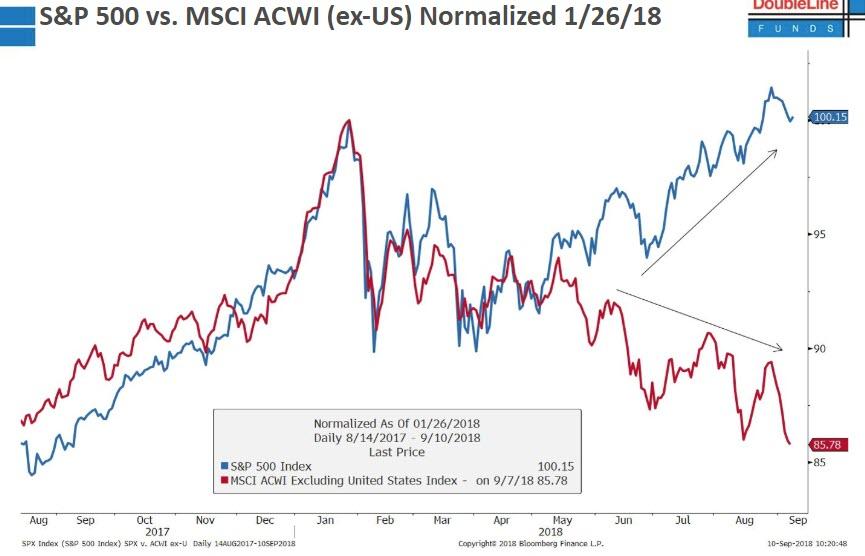

The “alligator jaws” chart presented by Jeff Gundlach during his Double Line conference call on Tuesday, which showed the unprecedented divergence between the US stocks and the rest of the world…

… was on display overnight, when Asian markets slumped once again, defying repeated calls for a rebound, as the MSCI Asia Pacific Index ex-Japan posted its 10th consecutive decline, the longest losing streak since 2002…

… although European stocks advanced modestly on Wednesday while US stock futures were once again in the green.

MSCI’s all-country equity index inched up marginally, looking to extend two sessions of modest gains that had snapped six straight days of losses. But emerging equities retreated to new 15-month lows, while fresh sparring between Washington and Beijing over trade kept world stocks close to three-week lows on Wednesday, and a slight dollar pullback gave little respite to emerging markets; the Indian rupee plumbing new record lows. Treasury yields edged lower after climbing a day earlier.

Meanwhile, as Bloomberg notes, central banks are back in the spotlight this week, with market participants increasingly preparing for the Fed to raise rates twice more in 2018, and policy meetings on the schedule for the European Central Bank and Bank of England, as well as Turkish and Russian central banks. Meanwhile, investors will be gauging the potential for extreme weather to disrupt economic activity, as threats from trade tension and Brexit, negotiations linger.

“What the market needs is a signal of some relaxation in trade rhetoric, a bit of climb down,” said Lombard Odier’s Salman Ahmed. “That should be enough as fundamentals are strong. But you do need a trigger point and so far we have not seen it.” Another catalyst could be signals from the U.S. Federal Reserve that it could slow the pace of rate rises but given the torrent of strong U.S. data, that looks unlikely: data this week showed U.S. small business optimism at the highest level on record.

As a result of these two trends, Asian equities excluding Japan hit their lowest since July 2017 as the Shanghai Composite dipped below the 2016 closing low and most regional currencies declined.

Japan also closed in the red, down -0.3%, as the Yen halted a three-day drop against the dollar, pressuring stocks: “equities, particularly the Nikkei, are not having a good day and as a result USD/JPY has given back some of Tuesday’s gains,” said Rodrigo Catril, a currency strategist at National Australia Bank Ltd. in Sydney.

Emerging currencies also stayed under pressure, with the yuan slipping to a two and a half week lows against the dollar leading Asian peers lower and keeping the Australian dollar heavily linked to Chinese trade, close to its lowest since February 2016.

Australia’s dollar fell toward a more-than-two-year low, dropping as low as 0.7094 after the Westpac consumer confidence fell 3% m/m in Sept, after dropping 2.3% in August and as declines in Asian stocks, the offshore yuan, and iron ore sapped demand for the currency. As discussed yesterday, emerging markets have been the biggest victims of the trade spats and rising U.S interest rates. The MSCI index of emerging currencies is down over 8% this year.

Emerging markets’ woes are being exacerbated by heavy dollar-denominated borrowing over the past decade, with Societe Generale analysts noting that “the misallocation of capital following a decade of cheap money is starting to be exposed”

Meanwhile, while the Turkish lira and Argentine peso have steadied off record lows, the Indian rupee continues to plumb new lows, taking year-to-date losses versus the dollar to more than 12%. “The rupee … is symptomatic of the overall situation in emerging markets, but it also embeds some idiosyncratic problems – with the fiscal deficit growing and the current account deficit widening on back of rising commodity prices,” said Cristian Maggio, head of emerging markets strategy at TD Securities.

European stocks shook off Asia’s woes on Wednesday and were modestly in the green, led by energy companies and miners who were among the biggest winners in Europe as Bloomberg’s commodity index rose. Futures on the Dow, S&P 500 and Nasdaq advanced even as America’s East Coast battened down for Hurricane Florence.

The dollar dipped 0.2% lower against a basket of currencies as hopes grew of concessions by Canada that would resolve disputes over reworking the North American Free Trade Agreement. The euro slipped and German bonds rallied after the news that ECB is to cut its growth outlook for the euro area while euro-zone industrial production fell 0.8% m/m in July vs est. 0.5% drop; the pound fluctuated after comments by European Commission President Jean- Claude Juncker who said he would work “day and night” for a divorce deal with the U.K. on Brexit though Britain can’t stay in “parts” of the bloc’s single market; it also slipped off five-week highs hit this week against the dollar, following the latest news from ITV about a Brexiteer plot to oust Theresa May.

Two-year Treasury yields held near a decade high and the dollar edged lower. Long-dated U.S. bond yields stayed just off the one-month highs hit on Tuesday after data showing sustained strength in the jobs market and the Treasury started a record debt sale amounting to almost $150 billion. The rise in U.S. TSY yields has hit Italy. It has been one of the bright spots in world markets in recent days, as fears have receded of a government spending binge. But Italian 10-year yields rose 2 bps off six-week lows.

Leave A Comment