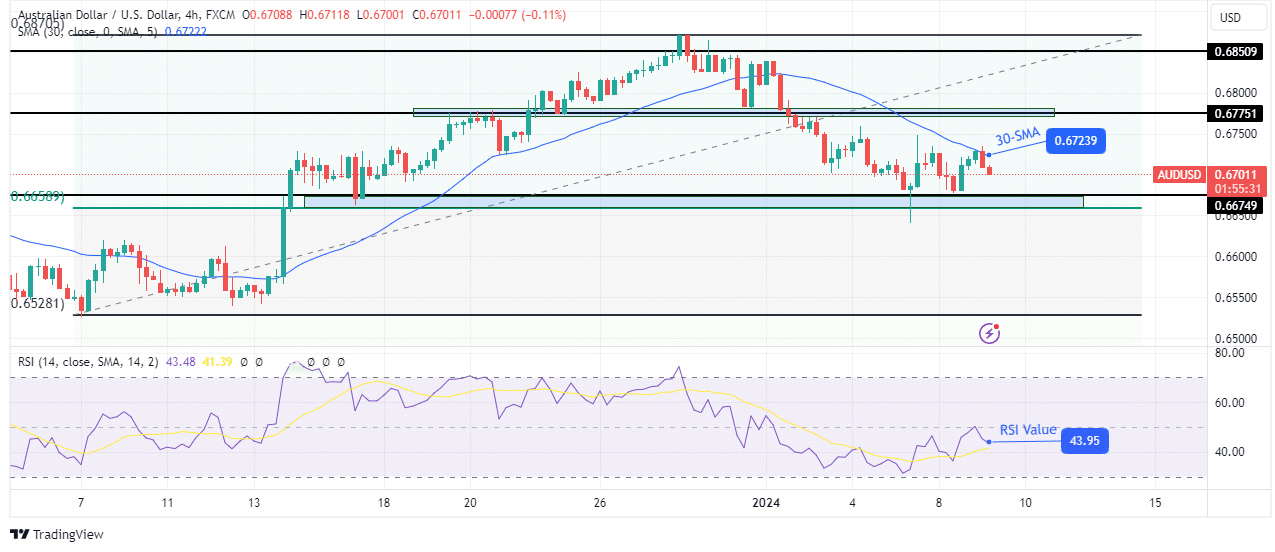

On Tuesday, the AUD/USD outlook took a bearish turn, influenced by a strengthening dollar as investors strategically positioned themselves in anticipation of the upcoming US inflation report. On Thursday, the US inflation reading will likely provide additional insight into the Fed’s policy outlook in the coming months. In Australia, November retail sales experienced the most significant surge in two years due to Black Friday discounts.Despite a 425-basis-point increase in interest rates, consumer spending has remained resilient. This is attributed to rising house prices, a population surge, and savings from pandemic stimulus measures. However, the Reserve Bank of Australia will likely disregard the November retail sales result, considering the distortion caused by Black Friday sales.Meanwhile, swaps indicated that the RBA’s tightening campaign is likely over. Moreover, there will be approximately 40 basis points of easing in for 2024.Elsewhere, an ANZ survey revealed a significant increase in consumer confidence in Australia at the beginning of 2024. It reached the highest level in almost a year. Notably, confidence among homeowners increased sharply due to rising house prices and the belief that interest rates have likely peaked.Meanwhile, data on Monday showed that US consumers’ short-term inflation projections reached the lowest level in almost three years in December. Consequently, bets on Fed rate cuts edged higher. AUD/USD key events todayNo major events will be released today from Australia or the US. Therefore, investors might remain cautious ahead of inflation readings from both countries. AUD/USD technical outlook: Price respects 30-SMA resistance  AUD/USD 4-hour chartAussie bulls failed an attempt to push above the 30-SMA, allowing bears to resume the downtrend. The pullback to the SMA came after the price paused at a strong support zone comprising the 0.6674 support and the 0.618 fib levels. Previously, the bearish move tried to break below the support zone, but the move was sharply rejected, making a big wick. A break above the 30-SMA would signal a bullish takeover, allowing the price to retest the 0.6775 resistance level. However, given that the price is still below the SMA and the RSI is below 50, the bias is still bearish. Therefore, the price will likely retest the support zone.More By This Author:GBP/USD Outlook: Investors Eye US Inflation For Policy GuidanceUSD/CAD Forecast: Dollar Gains As Market Brace For US InflationGold Price Turns Bullish As FOMC Minutes Weigh On Greenback

AUD/USD 4-hour chartAussie bulls failed an attempt to push above the 30-SMA, allowing bears to resume the downtrend. The pullback to the SMA came after the price paused at a strong support zone comprising the 0.6674 support and the 0.618 fib levels. Previously, the bearish move tried to break below the support zone, but the move was sharply rejected, making a big wick. A break above the 30-SMA would signal a bullish takeover, allowing the price to retest the 0.6775 resistance level. However, given that the price is still below the SMA and the RSI is below 50, the bias is still bearish. Therefore, the price will likely retest the support zone.More By This Author:GBP/USD Outlook: Investors Eye US Inflation For Policy GuidanceUSD/CAD Forecast: Dollar Gains As Market Brace For US InflationGold Price Turns Bullish As FOMC Minutes Weigh On Greenback

Leave A Comment