The weak wage growth in Australia continued to hurt consumer spending and the entire retail sector despite healthy labor market.

According to the Australian Bureau of Statistics (ABS), retail sales rose 0.1 percent in January, better than the 0.5 slump recorded in December but well below the 0.4 percent forecast by most experts.

Core retail sales excluding food items increased by 0.1 percent following a 1.4 percent decrease in December.

Even though, the Reserve Bank of Australia said the sector is growing at a moderate pace despite strong competition between retailers, it is unlikely retail sales will pick up soon because of the weak wage growth and rising household debt.

Also, the inflation rate is likely to remain below the central bank’s target for a long time as price competition between retailers is expected to further weigh on headline inflation and hurt business profits like the second half of 2017.

Therefore, the Reserve Bank of Australia is expected to leave its interest rate unchanged at 1.50 percent later today.

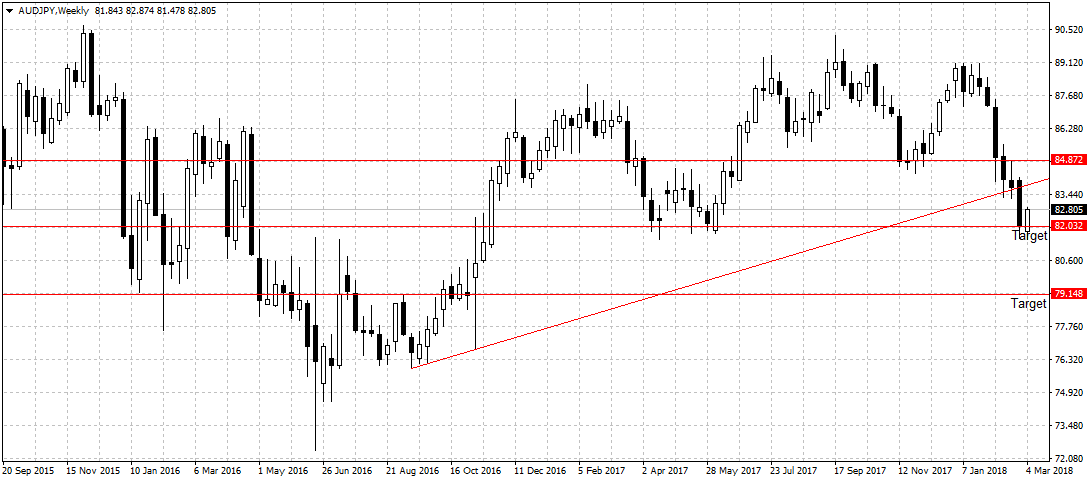

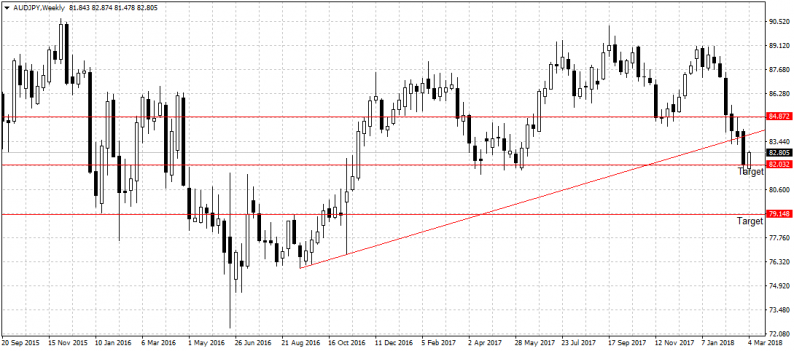

The Australian dollar gained against the Japanese Yen ahead of rate decision. However, we remained bearish on AUDJPY as projected in the forex weekly outlook.

Leave A Comment