Australian Dollar Fundamental Forecast: Bullish

Just getting started in the AUD/USD trading world? Our beginners’ guide is here to help

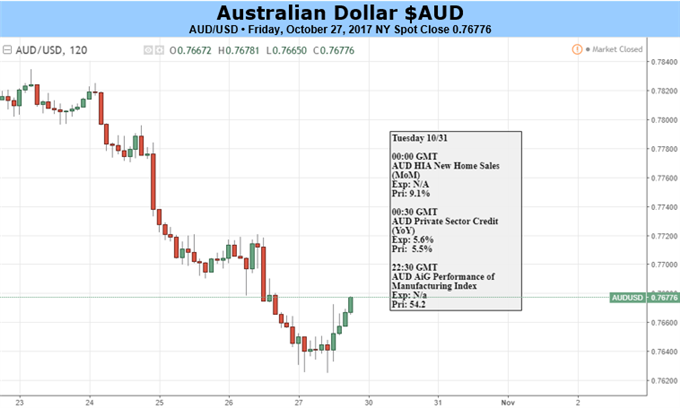

The Australian Dollar was clobbered last week by some

unexpectedly weak

official inflation data.

The third-quarter’s Consumer Price Index rose by 0.6% compared to the second’s, and by 1.8% on the year. Forecasters had expected respective gains of 0.8% and 2%. Now it’s possible that the current quarter’s numbers will be lacklustre too. They’ll be released following a review of the methodology which is used to calculate the data. This regular process tends to lower readings. All up it looks as if Australian inflation is heading towards year-end in rather shaky fashion.

Moreover, last week’s shock arrived as the Australian Dollar was weakening anyway. Market perceptions that the Reserve Bank of Australia is in no hurry to lift the Official Cash Rate from its 1.50% record low have grown in the last couple of weeks. And the RBA itself loses few chances to talk the currency down. This doesn’t look like a very constructive backdrop for the Australian Dollar against the greenback or, indeed, pretty much any other currency you like.

The coming week offers few obvious opportunities for the Aussie to get out of jail. The US Federal Reserve’s November monetary policy meeting will give its dispensation on Thursday and that will of course be the global market highlight.

That said confirmation that the Fed remains on course to raise interest rates in December can hardly be expected to support the US Dollar much more. This prospect has been live for months and must surely be priced in. All may hinge on how hawkish the central bank is held to be beyond the end of this year. Any hesitancy could see AUD/USD firm.

Leave A Comment