In our last commentary on the Australian dollar, we wrote that the currency was an enticing short opportunity thanks to slowing Chinese growth and a bearish trend. Specifically, we recommended shorting AUD/USD as means to express a bearish view on the currency. Since that time, the pair has weakened (from 0.7560), and is trading around 0.7280 on August 13.

Going forward, we see further declines in the Australian dollar against the US dollar. While some domestic economic indicators are rebounding, we expect decelerating Chinese growth, the associated weakness in commodities, and an ongoing rally in the US dollar to outweigh any positive domestic developments. Worsening US-China trade tensions (many are already calling it a trade war) are also expected to weigh on the Australian dollar going forward.

Following epic stimulus program, Chinese growth set to keep decelerating

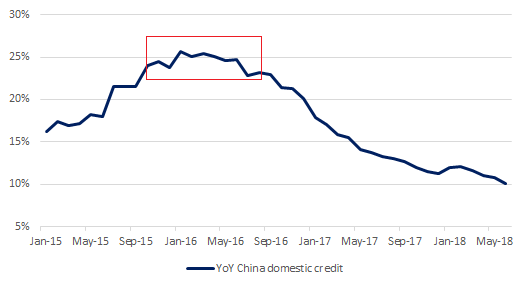

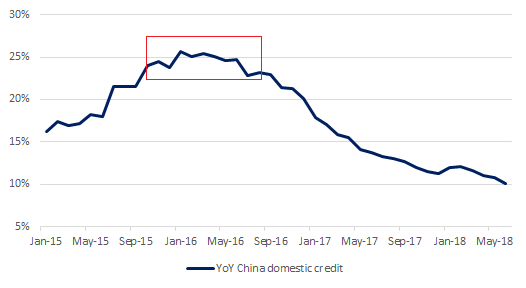

In early 2015, China embarked on a stimulus program in order to better manage its downturn at the time. Similar to its previous efforts, the government significantly expanded domestic credit and focused its efforts on physical infrastructure investments. As a big exporter of industrial commodities such as copper, coking coal and iron ore, the Australian dollar tends to rally in response to accelerating Chinese growth. An overview of recent trends in credit growth is shown below for reference:

China credit: here comes the hangover

Source: People’s Bank of China, CEIC, MarketsNow

As can be seen in the chart above, Chinese stimulus efforts (on a rate-of-change basis) peaked in early 2016. Unsurprisingly, early 2016 also marked a turning point for most commodities and emerging market financial assets. Given China’s big appetite for commodities, changes in Chinese growth have a significant influence on commodity prices.

Recent weakness in commodities also point to slowing growth

Beyond patterns in domestic Chinese credit growth data, market-based indicators of Chinese growth also suggest an oncoming slowdown. Given the strong relationship between future global growth and copper, the metal is often called “Dr. Copper” for its forecasting powers. Copper is especially useful for front-running changes in Chinese growth as more than half of the world’s copper production is destined for China. Historical copper prices and futures trading volumes are shown below:

Leave A Comment