Avon Products Inc. (AVP – Free Report) reported loss per share in line with estimates in first-quarter 2018 while revenues topped estimates. Results included gains from the new revenue recognition standard adopted in the first quarter of 2018.

Q1 in Detail

Avon posted adjusted loss per share of 2 cents in the first quarter, in line with the Zacks Consensus Estimate. Additionally, it reflected an improvement from a loss of 7 cents per share in the prior-year quarter.

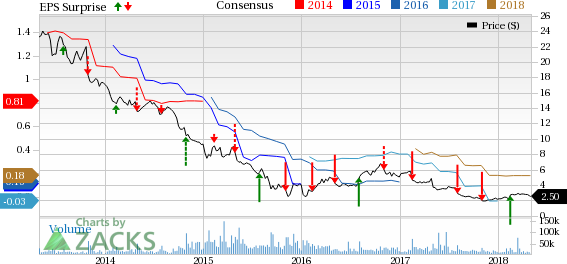

Avon Products, Inc. Price, Consensus and EPS Surprise

Avon Products, Inc. Price, Consensus and EPS Surprise | Avon Products, Inc. Quote

On a reported basis, the company posted loss per share of 6 cents compared with loss per share of 10 cents in the year-ago quarter.

Deeper Insight

Total revenues improved 5% year over year to $1,393.5 million and surpassed the Zacks Consensus Estimate of $1,365 million. On a constant-currency basis, total revenues increased 2%. Results for the quarter include the benefit of the new revenue recognition standard. However, the top line was impacted by lower Active Representatives, mainly in Brazil and Mexico along with challenges in key markets, particularly in Brazil.

However, Active Representatives declined 4% compared with the prior-year quarter, driven by fall in South Latin America and North Latin America. Ending Representatives dipped 1% on account of softness in South Latin America and North Latin America, offset by growth in Europe, Middle East & Africa. Moreover, average orders improved 6% and price/mix rose 5% while total units sold dropped 3%.

Adjusted gross margin contracted 280 basis points (bps) year over year to 58.4%, driven by higher supply-chain costs, partly negated by positive impact from price/mix. Further, gross margin included a 310 bps negative impact from the adoption of the new revenue standard.

Adjusted operating margin expanded 100 bps to 4%. The year-over-year increase was due to lower bad-debt expenses, particularly in Brazil; partly compensated by higher Representative, sales leader, and field expenses. It also included a 120 bps positive impact from the new revenue standard.

Leave A Comment