Copa Holdings, S.A. (CPA – Snapshot Report) is feeling the pain of Brazil’s recession. This Zacks Rank #5 (Strong Sell) is expected to see earnings drop by 50% this year.

Copa is a passenger and cargo airline that operates out of Panama City, Panama. It flies 99 aircraft to 74 destinations in 31 countries in North, Central and South America as well as the Caribbean.

Copa had been riding a wave of middle class growth in Brazil and Central America but Brazil’s recession and troubles in Venezuela, one of its larger markets, has put a damper on the story.

August Trends Still Down

On Sep 14, Copa announced its August passenger traffic statistics.

Revenue passenger mile (RPM), one of the key airline metrics, fell 3.5% to 1,344 from 1,392 in August of 2014.

The load also fell 3.5 points to 74.4% from 77.9% a year ago as capacity rose 1%. For the year, the load is down 3 points to 75 from 78.

None of this is surprising, however, given the state of the Brazilian economy and the stress on the real.

2015 and 2016 Estimates Fall

Copa is uniquely situated in Central America to tap into the expanding economy there and the increase in air travel for both business and leisure. But right now, it can’t do much to escape the economic situation.

The analysts have been cutting both 2015 and 2016 estimates.

Earnings are expected to fall 51% in 2015. The Zacks Consensus Estimate has been cut to $5.47 from $7.59 just 90 days ago.

For 2016, the Zacks Consensus has been slashed as well. It has fallen to just $5.25 from $8.61 just 3 months ago.

This is another 4% decline in earnings.

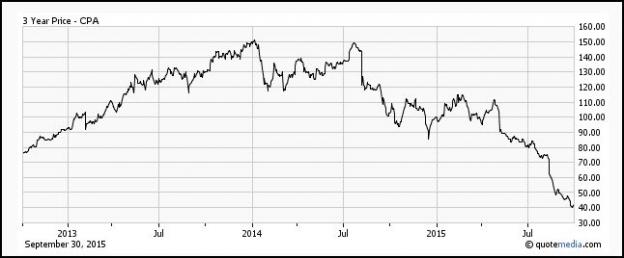

Shares Plunge to New Multi-Year Lows

Investors have been fleeing Copa’s stock for some time. Shares are down 50% in just the last 3 months and are at new 3-year lows.

While they look cheap, with a forward P/E of just 7.6, airlines have historically traded with a lower P/E ratio than the overall market.

Copa also appears to have a juicy dividend, yielding 8.3%, but I would be leery of that sticking around for the long haul if Brazil’s economy remains in recession.

Leave A Comment