Down cycles during times of weak demand makes it difficult for a company to manage any excess capacity, and it tends to negatively impact margins for several quarters at a time.Further, the company is then left waiting for improvements in the macro environment to enable them to rebound from the down cycle.This is the situation that Diodes Incorporated (DIOD) is currently facing, who is also the Zacks Bear of the Day.

This Zacks Rank #5 (Strong Sell) is a leading manufacturer and supplier of high-quality discrete and analog semiconductor products, primarily to the communications, computing, industrial, consumer electronics and automotive markets. The Company’s corporate sales, marketing, engineering and logistics headquarters is located in Southern California, with two manufacturing facilities in Shanghai, China, a wafer fabrication plant in Kansas City, Missouri, engineering, sales, warehouse and logistics offices in Taipei, Taiwan and Hong Kong, and sales and support offices throughout the world.

In their most recent quarter, Diodes saw revenues decline -10.6% YoY, gross profits fell -17.5% YoY, and GAAP net income plummeted -85.6% YoY.Further, gross profit margins fell from 32% to 29.5% YoY.Also, management guided Q4 revenues about $10-12 million below current expectations of $200 million.

Looking forward Dr. Keh-Shew Lu, President and CEO, stated, “We currently expect this weak environment and the distributor inventory adjustments to extend into the fourth quarter so we have taken additional measures to carefully manage expenses, including reductions in travel and vendor expenses as well as a freeze on new hires.”

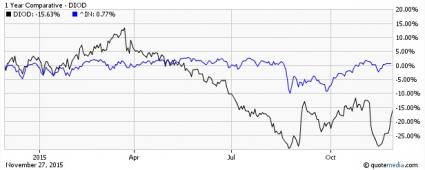

As you can see in the graph below, Diodes has been underperforming the S&P 500 for the past six months.

Decreasing Estimates

Due to the negative outlook estimates for Q4 15, FY 15, Q1 16, and FY 16 have all collapsed; Q4 15 fell from $0.31 to $0.04, FY 15 dropped from $1.20 to $0.76, Q1 16 slipped from $0.31 to $0.05, and FY 16 crashed from $1.52 to $.87.

Bottom Line

As management shifts their product mix lower they are attempting to maintain high utilization rates to improve margins, while they await better economic conditions to climb out of their current down cycle. Unfortunately, this process is putting significant pressure on margins and overall revenues. This pressure is expected to last through the fourth quarter and into the beginning of 2016.

If you are inclined to invest in the Electronic Component/Semiconductor segment, you would be best served to look into Ceva Inc (CEVA – Snapshot Report), Integrated Device Technology (IDTI – Snapshot Report), or Mellanox Technologies (MLNX – Snapshot Report), all of which carry a Zacks Rank #1 (Strong Buy).

Leave A Comment