At the beginning of the year, regional bank stocks like Fifth Third (FITB – Analyst Report) looked to be prime position. The prospect of higher interest rates was going to boost companies in this sector by increasing the spread between what they paid out on deposits, and what they could earn on loans. What a difference a few months make though.

Increased market volatility, central banks around the world cutting rates, and a still sluggish economy, have dulled the likelihood of a series of rate hikes this year. In fact, for a brief period, investors were pricing in a rate cut from the Fed, though at least that speculation has died down.

New Outlook

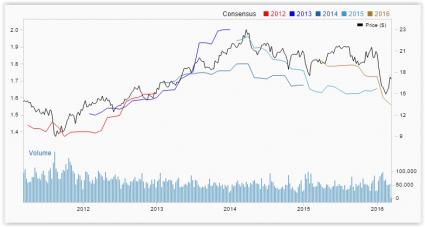

Still, investors have had to reevaluate how they feel about companies in the regional banking sector and Fifth Third is a perfect example of this shifting sentiment. The Ohio-based company has seen a drastic change in analyst opinion of the company’s earnings prospects in just the past two months.

For the current quarter earnings projections, 10 estimates have gone lower while zero have gone higher in the past two months. The full year period is even worse, as 16 estimates have gone lower in the past two months while zero have gone higher. And now, for both periods, analysts are expecting earnings to contract when compared to the year ago period.

In total, the consensus estimate has fallen by about 7.9% in the past sixty days for FITB stock, while it has slid about 8.8% when looking at the full year. And the hits keep on coming as estimates that have come out in just the past week have also been lower and are looking to push the consensus further in the wrong direction.

Maybe a Surprise?

And unfortunately for investors, analysts seem to be pretty spot-on in their expectations for FITB stock over the years. Over the past six reports, only in one was FITB able to surprise by more than 10% while three of the times actuals came in line with the estimates. So it isn’t like FITB has a great history of surprising at earnings season either.

Leave A Comment