Despite a booming rail transport cycle, analysts can’t seem to downgrade Greenbrier (GBX – Snapshot Report) often enough lately, largely after institutions have buried the shares by half since the spring.

It seems they are trying to get ahead of what they see on the horizon: a decline in industrial manufacturing and oil transport trends that Greenbrier rail cars have banked on for the past 5 years.

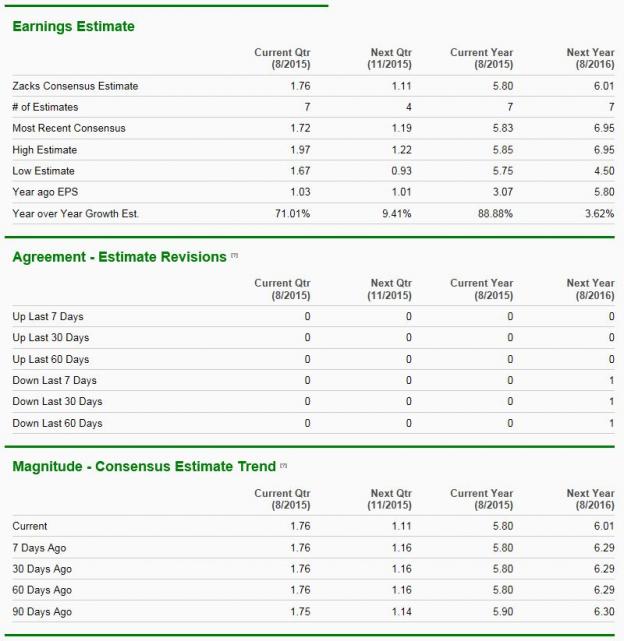

While a 7% miss on earnings last quarter didn’t help the outlook, what is amazing is how even reduced EPS estimates still have GBX trading at under 6X next year’s projected $6. Here are the detailed Zacks EPS tables showing the downward revision trend of the past 90 days…

Bottom line: GBX shares appear to be an incredible value, but that doesn’t mean the downward earnings momentum has stopped. Until it does, it’s best to wait for a different mode of transport. The Zacks Rank will let you know.

Leave A Comment