It hasn’t been smooth sailing by any stretch of the word for companies in the shipping industry lately. An uncertain outlook for global growth and mixed trading in the oil market has led to some wild moves for the space in recent months. It also hasn’t helped that the Baltic Dry Index hit fresh five year lows in February, suggesting that more pain was ahead for the space.

However, recent trading for the dry bulk index has been more favorable and we are now at 2016 highs for this important benchmark. Oil has also moved back off of its lows which has given more hope to companies in the space.

A great example of these trends is with Nordic American Tankers Limited (NAT – Snapshot Report), as the company has faced the same ebbs and flows as the industry at large. And this company, which operates over two dozen oil tankers, has stormed back to breakeven for 2016, a huge feat considering it was down 20% on the year in early February.

However, this may actually just be a great time to exit this company, as a return to more sluggish trading could be ahead, at least if we look to recent estimates, and a few specific metrics for NAT stock.

NAT metrics

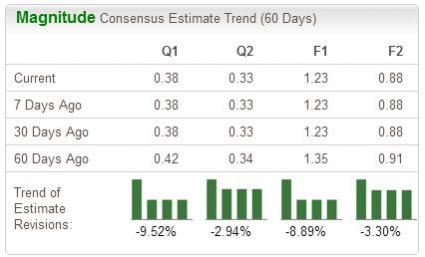

While NAT has seen a few estimate cuts, NAT hasn’t seen any analysts raise their estimates for NAT earnings over the past sixty days. This includes looks at the current quarter, the current year, and the next year time frame too. Growth rates are now projected to be negative for the full year, and even worse for the next year.

It also doesn’t help that NAT doesn’t have the best history in earnings season, as it has had trouble living up to expectations in the past. It is actually posting an average miss over the past four quarters, including last quarter’s 26% miss. No wonder NAT has a Zacks Rank #5 (Strong Sell) and that we are looking for a return to underperformance this quarter, and are worried by the prospect of the earnings report which is coming in roughly a month’s time.

Leave A Comment