My Swing Trading Approach

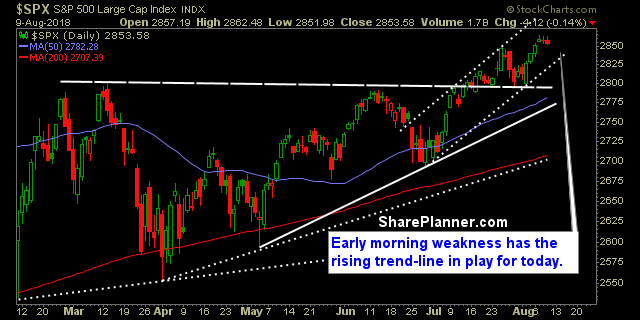

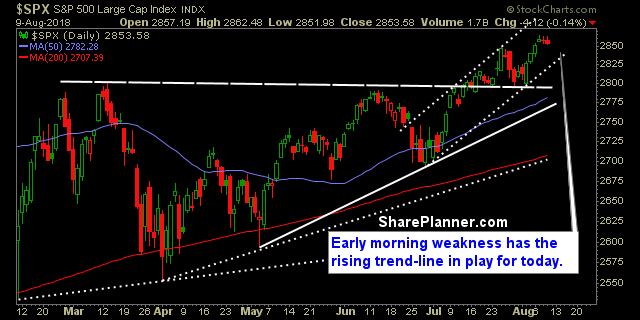

Be very careful with today’s market. I may add some short exposure today if the market provides me with the opportunity to do so. Otherwise, I will follow my stops on my existing two positions and go from there.

Indicators

Sectors to Watch Today

Telecom attempting to come out of a well-defined base that it has been working on since May. Series of higher-highs and higher-lows have been established as well. Utilities may find some interest with the market selling off in the AM. Staples continues its four-day pullback to breakout support, but may also catch a bid this morning as well. Energy appears ready to weaken beyond its two-week consolidation pattern.

My Market Sentiment

Bears are coming in hot at the open with a huge gap down in play. As has been the norm of late, gap downs and gap ups, tend to get faded. See how the market reacts to today’s price action early on.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment