In commemoration of the bull market’s 9th anniversary, we wanted to take a brief moment to highlight some of the equity market’s biggest winners and losers over the last nine years. We’ll start with the losers. Within the current universe of S&P 1500 stocks, a total of 60 names have share prices that are lower now than they were on the day the market bottomed. That’s a pretty forgettable accomplishment when you think about it, and suggests that these companies whether through their own or the fault of a larger macro trend, have had some major issues to contend with.

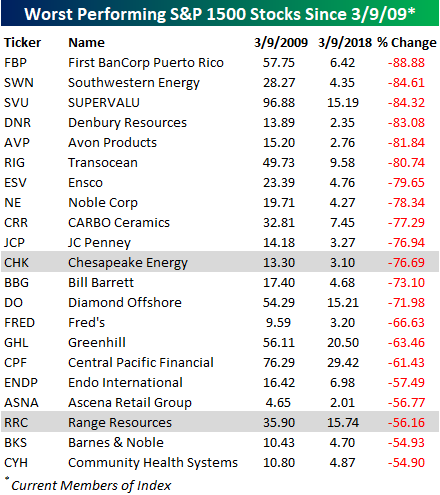

The table below lists the 21 current members of the S&P 1500 that have seen their share prices decline 50% or more during the bull market. Most of these names are either small or mid-cap names that you may have never heard of, but a lot of companies formerly considered high-quality, like JC Penney (JCP) and Barnes and Noble (BKS), are also listed.The only two stocks listed that are in the S&P 500 are Chesapeake Energy (CHK) and Range Resources (RRC).

Now to the winners. Since the bull market began, 206 current members of the S&P 1500 have been ten-baggers, meaning that investors who held them the entire time have made over ten times their money. Below we list the 25 best-performing stocks of the group. All 25 of the names listed have gained more than 3,000% (thirty times your money), and 12 are up by over 5,000%.

The biggest winner, though, has been Patrick Industries (PATK). On March 9, 2009, PATK closed at 16 cents. Nine years later, its share price is $64.70 for a gain of 41,480.98%. Most people have never heard of PATK, but looking at the list there are a number of well-known S&P 500 companies listed as well. As shown, GGP, United Rentals (URI), and Netflix (NFLX) are all 50-baggers .With gains like the one listed below, there’s a reason why they often say that the biggest fortunes are made during bear markets.

Leave A Comment