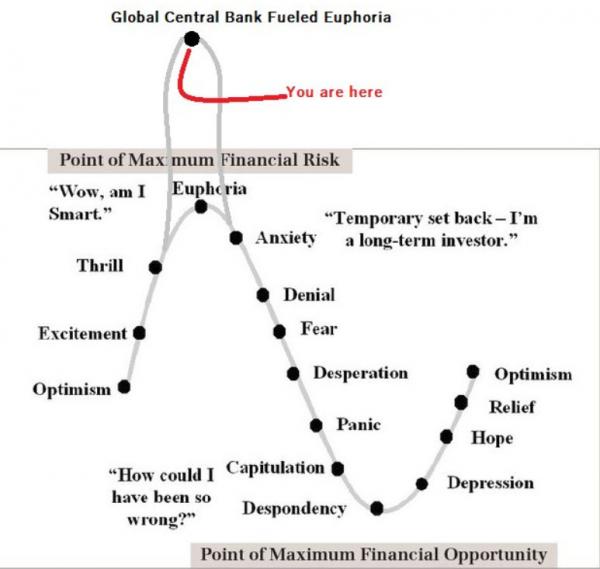

Overheard on CNBC today… “today we get proof this is not a bubble…”

Video length: 00:02:44

Nope..

h/t @Stalingrad_Poor

So Catalan secedes and Spain loses 22% of its GDP and still the Spanish stock market is outperforming the S&P in USD terms…

Before we start – let’s take a quick look at today’s cross-asset-class moves – Stocks Up (well durr!), VIX crashed (back below 10), Bonds Up (wait… that doesn’t make sense), Gold Up (woah, why)… and the Dollar Down… (certainly doesn’t sound like the epic stock market environment that the media proclaims it to be)…

This is the 5th weekly rise in a row for Nasdaq (best day since the election), 7th in a row for S&P and Dow… but Small Caps and Trannies ended the week red…

The Dow barely managed gains on the day…

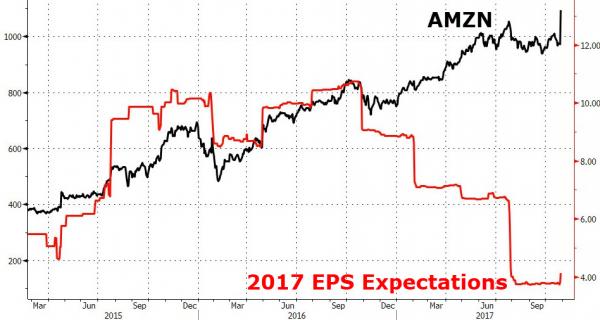

Of course today was all about AMZN (best week since April 2015) and the big tech stocks… and as AMZN squeezed over 13% higher on the day, so Nasdaq followed…

VIX tumbled on the day, back below 10 – after topping 13 in the middle of the week…

And while Nasdaq VIX had decoupled from the index, today saw them reconnect somewhat as vol collapsed…

But can you spot the week’s odd ‘tech’ out…

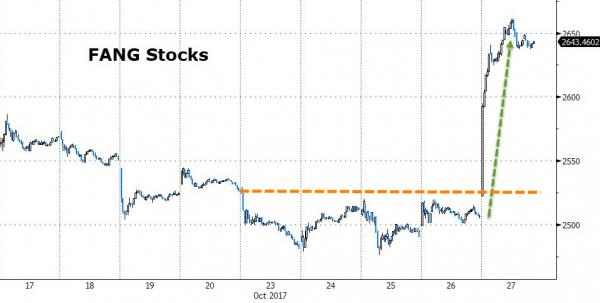

FANG Stocks best week in 3 months…

Given the decoupling between AMZN and its EPS expectations…

Perhaps you are wondering why it just hit $1100…(correlation between the level of G3 balance sheets and AMZN for the last year is well above 95%)

5 Tech stocks alone added a stunning $200 billion market cap today…

Leave A Comment