Economic Reports Scorecard – 11/6/15 to 11/20/15

The economic data continues to come in largely less than expected with the manufacturing/industrial parts of the economy faring worst. In what may be a developing trend, housing starts were less than expected and with last home sales reports makes for a short string of weaker reports. Generally, real estate has been trending slowly higher for the last few years and this is probably just a blip but it is certainly worthy of our attention. The labor market continues to be steady if unspectacular but weekly jobless claims may have finally bottomed out. They aren’t yet in any kind of uptrend though so nothing to worry about just yet. My biggest concern continues to be the inventory situation which got a little worse in the latest reports. That might explain the slowdown in port activity that has been recently reported and will likely weigh on production further at some point.

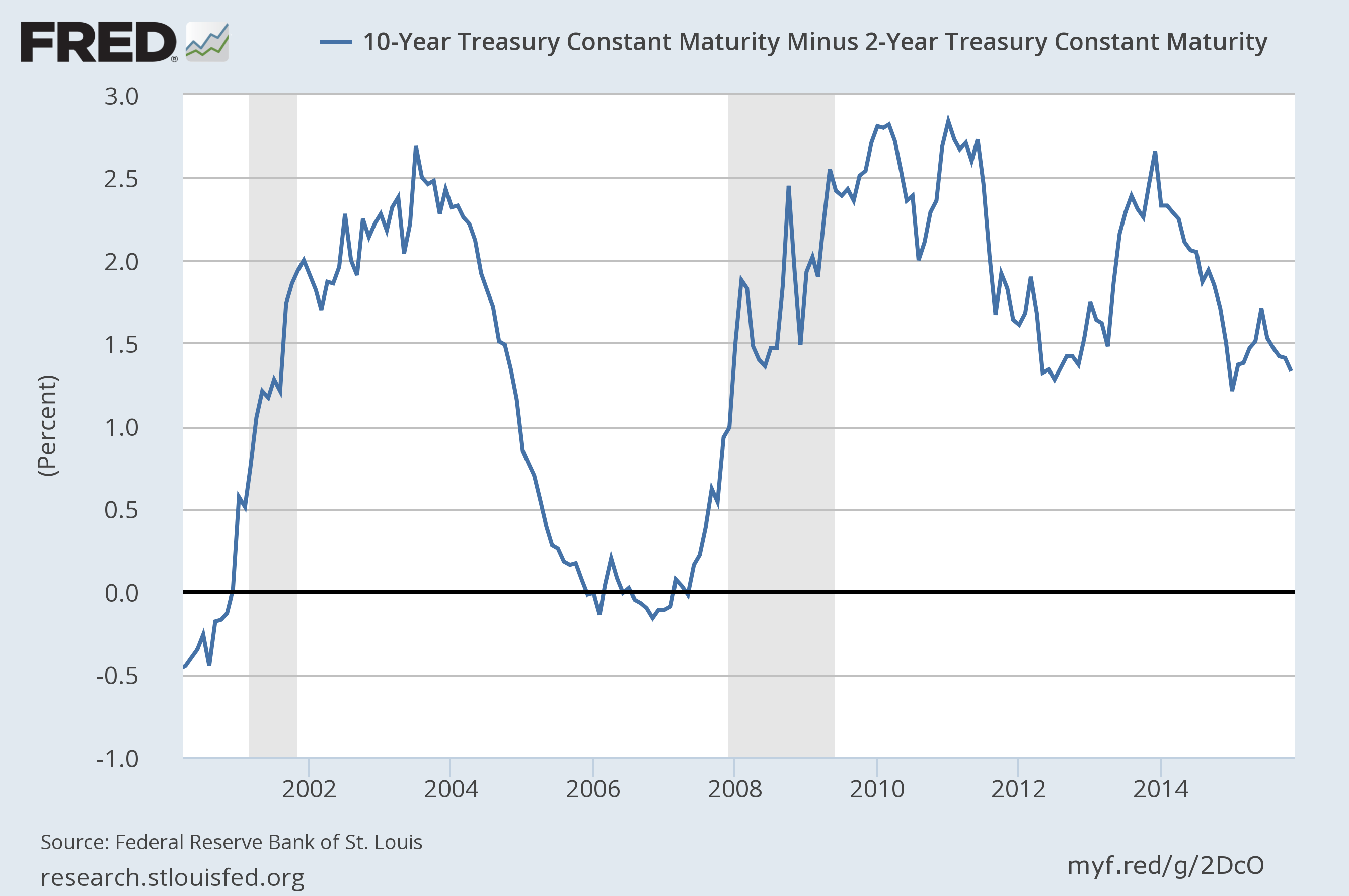

Market based indicators were about as mixed as the economic data which makes sense. Long term treasury yields fell in the context of a generally flattening curve. The curve is still in the middle of its historic range and as I’ve said many times, we don’t know if the curve will get to flat before the next recession. Actually the sign that the market is seeing and anticipating more economic weakness would be a steepening curve where short rates collapse faster than long rates. That has traditionally happened from a near flat curve but there is nothing that says it can’t happen from here.

The dollar was essentially flat since the last report although there is an obvious bias toward strength. Sentiment is very bullish on dollars though and the lack of follow through ought to worry the bulls. For now though, long term momentum still points higher. That ought to continue to push down inflation expectations and be supportive of longer dated bonds. It should also continue to attract capital to the US and with little in the way of actual investment opportunity, it seems probable that it will end up in financial markets. It wasn’t coincidence that the dot com bubble happened in the midst of a strong dollar period.

Leave A Comment