Last week a lot of attention was paid to the big changes at the Harvard Management Company, the managers of the $35 billion Harvard Endowment. Half of the staff will be cut over the next couple of months and it will outsource management of more of its assets.

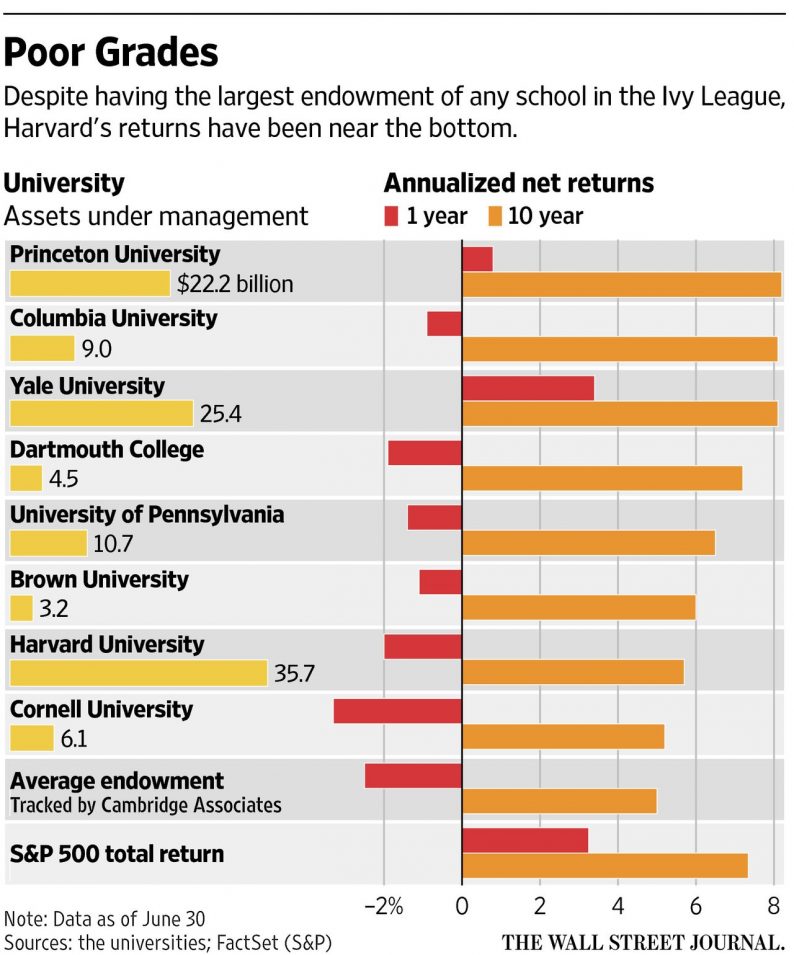

The performance has drawn criticism in recent years as the top spot at the firm has been something of a revolving door since Jack Meyer was pushed out. This chart from the WSJ captures the point;

Obviously most of the endowments listed lost money in the year ending June 30th, 2016. To the extent these are really global macro funds (you might disagree), Barron’s coincidentally had an article about last year being a bad year for global macro relative to other hedge fund strategies. What makes them different from the typical 60/40 portfolio is that the time horizon is infinite. Barry Ritholtz pointed out that Harvard is 400 years old and that with an infinite time horizon, the sorts of drawdowns captured in the table are meaningless.

Jack Meyer was well known for owning timber assets when he ran the HMC for its diversification benefits, he said it had no correlation to equities. This is part of what the so called endowment portfolio is all about and why so many investors who are not endowments have tried to emulate it; strong results that include sophisticated investments. For many years I have blogged about influence as opposed to emulation of the endowments.

Equities continue to be the asset class that goes up the most and the most amount of time. Commodities can go up a lot for a few years at a time but they don’t stay anywhere near equities.

The HMC annual report shows only 29% in publicly traded equities which is obviously low with another 14% in absolute return among other assets classes. Absolute return is not intended to keep up with equity bull markets. I believe absolute return to be a valid alternative strategy as a means of managing volatility but if the objective of a given manager, for example is CPI + 2% then the return will be quite small if the market goes up 10%. A 14% weighting then becomes quite a drag and absolute return is not the only alternative listed in the report.

Leave A Comment