On Tuesday afternoon, Jeff Gundlach held one of his more exhaustive “Just Markets” calls with investors.

Among the numerous discussion points touched upon, the “bond king” who alone predicted Donald Trump’s victory one year before the election, had several more bold contrarian calls, key among which was his observation that while stocks are now in an “accelerating phase”, his 2018 prediction is that the S&P would post a negative rate of return, which arguably is a more complex way of saying the S&P would be red for the year.

A main catalyst for Gundlach’s bearishness – for both bonds and stocks – is that we are now entering an era of quantitative tightening, i.e., accelerating balance sheet unwind from all the major central banks, which will lead to eventual derisking as yields first rise and stocks ultimately sell on the news.

Another reason why Gundlach is very bearish on the rates complex is that as BofA and JPM calculated last year, in 2018 there could be a $1 trillion bond supply deficit, a number which rises to $1.9 trillion in 2019 according to Gundlach.

Additionally, Gundlach is confident that a “more hawkish ECB” is not priced into the market. To be sure, last night’s quasi-tapering by the suddenly hawkish BOJ certainly lit a flame under long-dated yields today, sending the 10Y surging to 2.55%, breaking out above 2.5% for the first time since Marh 2017.

Going back to quantitative tightening, Gundlach also says that shrinking balance sheets are also not priced by the market, and in this context his bogey is June of 2018, at which point the net liquidity injection by central banks turns negative, or as he calls it, the point of “shrinkage.”

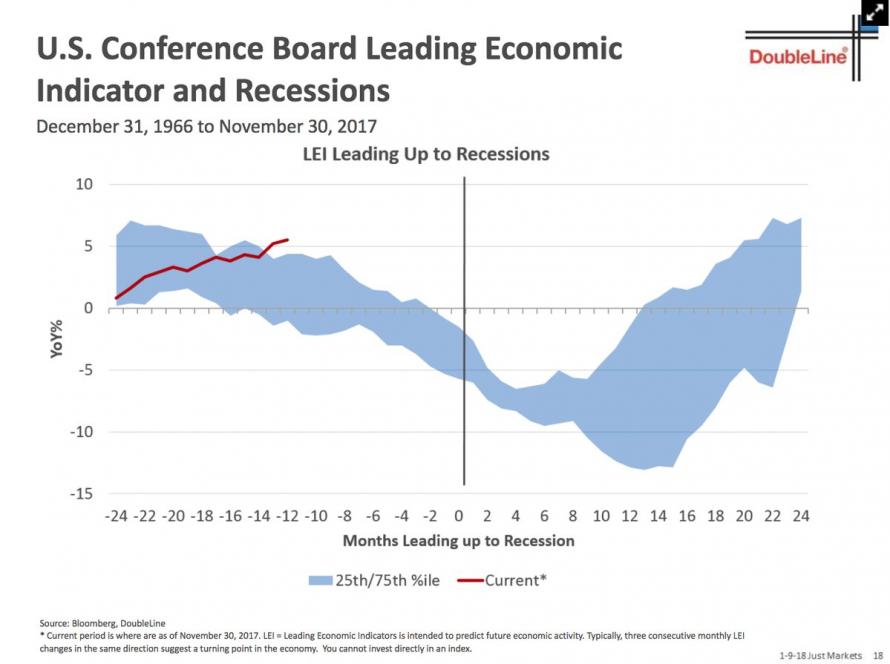

Which is not to say that Gundlach predicts a recession: far from it. Observing some of the main economic indicators that DoubleLine follows, Gundlach finds no recession risk in either the Leading Economic Indicators…

… nor in his favorite recession indicator, the US unemployment rate vs its 12 month simple moving average (a metric which looks at upward inflection points in the unemployment rate)…

Leave A Comment