Biotech Pulse

The cold winds of February cut into the market as stocks found themselves going in an unaccustomed direction. Sliding like a toboggan on a ski slope, stocks last week experienced the sharpest correction in over 50 years, reaching the -10% mark within a week.

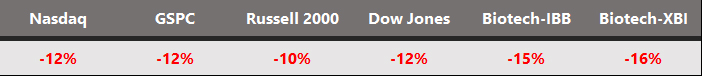

This marked the decline as a Correction, which many readers are aware is a technical term to indicate a 10% or more pullback in the stock market, as represented by major broad indexes like Nasdaq (QQQ), S&P 500 (SPY), and Russell 2000 (IWM), and even the narrower but widely followed Dow Jones Industrials (DIA). Any pullback that crosses the 20% threshold is adorned with its own animal kingdom moniker of a Bear market.

Biotechs went along for the precipitous ride down. The declines were much higher than broader indexes, due to the obvious higher beta and more volatile nature of the sector.

Stock Market Correction, February 2018

However, small and midcap biotechs resisted the fall and found support much earlier than the larger biotech companies. The Nasdaq Biotechnology Index (IBB), a proxy for large biotechs, sliced through the important 200-day moving average line before finding support at that key level. At the same time, the S&P Biotechnology Select Index (XBI), more weighted towards midcap and smallcap biotech companies, found support much higher at the 50-day moving average line.

This was somewhat counter-intuitive, as in times of stress there is a flight to relative quality which would suggest holding on to positions in more stable, larger cap biotechs at the expense of more speculative midcap and smallcap ones. We believe a key reason which explained the performance divergence this time around is a highly favorable transformation of the biotech investing landscape which is growing the risk tolerance for speculative biotech companies

Stocks Wilt But Will Not Wither

The key reason for the sharp decline in the market last week was the fear of inflation being stoked due to a faster-running economy, which can raise the pace of interest rate hikes by the Federal Reserve beyond the 3 currently envisioned for 2018. This is a legitimate argument and incipient inflationary pressures are beginning to emerge, as evidenced by wage growth in the January employment report, resulting in sharply climbing yields on the 10-year bond. In the Market Outlook article a few weeks ago, which discussed the various factors putting pressure on yields, we had mentioned Interest Rates as one of the three key stock market supports with the highest chance of springing a negative surprise. But that was more of a second-half concern.

Leave A Comment