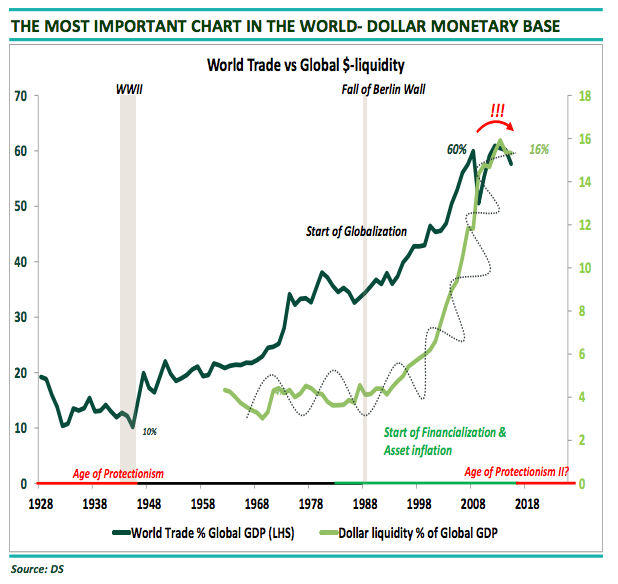

Another day, another stark warning about the perils inherent in following Donald Trump down the path to protectionist trade policies. When you think about Trump’s tariffs and the reciprocation they’ve elicited around the world, it’s important to strip the discussion of the niceties and superlative-laden populist balderdash.

What you’re witnessing is an epochal shift that, at heart, entails rolling back decades of progress on globalization and liberalization in the interest of promoting nationalism and isolationism. In other words: this is the very definition of a fool’s errand.

It won’t work, precisely because it can’t. I’ve been over this on too many occasions to count in these pages. The globalization of supply chains and the free movement of labor and capital make Trump’s policies an exercise in futility. Even if they were a good idea (which they unequivocally aren’t), they would have no hope of working in practice. Just ask Element Electronics or, amusingly, Chris Cox, the founder of “Bikers for Trump”, who discovered that the only way to make a profit selling Trump memorabilia at the nation’s largest biker gathering is to buy the shirts from Haiti.

There are of course more consequential examples involving multinationals, many of which have been warning for months about the deleterious effects of protectionism on their businesses.

One of the key things to understand about protectionism in the context of markets is the extent to which globalization has been a disinflationary force that’s helped keep inflation anchored in developed markets, thereby ensuring that central banks can keep the spigots open. Recall this from Nedbank’s Neel Heyenke and Mehul Daya:

A consequence of globalisation was disinflation which allowed central banks to cut policy rates (discount factors). This helped stimulate economic growth and fuel asset prices. The destructive inflationary episode of the 1970’s meant monetary policy became focussed on consumer inflation targeting.

If globalization slams into reverse thanks almost entirely to Trump and the populist sentiment he’s legitimized across developed market economies, it could very well drive up domestic prices with the effect of forcing the Fed to lean continually hawkish. That, in turn, would drive the policy divergence between the U.S. and the rest of the world wider and push the dollar higher, a risky dynamic that could spark an unwind in emerging markets and, ultimately, a recession in the U.S. in the event the Fed over-tightens.

The addition of fiscal stimulus to the late-stage expansion stateside makes that outcome more likely as it increases the chances that the Phillips curve snaps back to life dramatically.

“The Fed could be caught behind the curve and might be forced to hike aggressively which could have a negative impact on growth while leaving only inflation behind,” Deutsche Bank’s Aleksandar Kocic cautioned in June, in the context of the Phillips curve. He reiterated that point in a note dated Friday as follows:

Leave A Comment