Bitcoin’s price topped $10,000 again but reversed course soon after, as price volatility continued early on Friday. Critics of cryptocurrency advise others to steer clear of them because of the extreme volatility, although proponents note that adding another asset class to their investment portfolio would mean even more diversification. While bitcoin correlation with core asset classes is extremely low, making it potentially good for diversification, critics argue that there’s something more important than correlation when it comes to deciding whether to buy bitcoin or other cryptocurrencies.

In a recent report on cryptocurrencies, JPMorgan analyst John Normand said that what matters most is the impact including bitcoin or any other cryptocurrency will impact the risk-return characteristics of an investment portfolio. He explained that there are two main ingredients that create this impact: bitcoin correlation and price volatility.

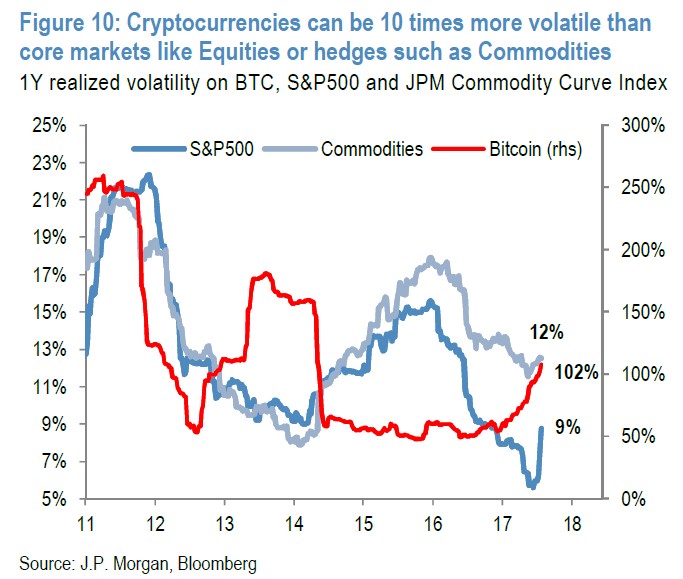

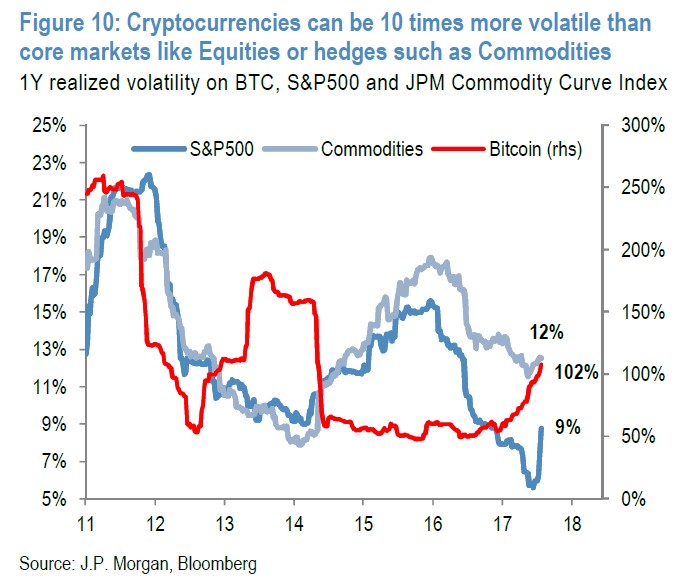

As far as the latter goes, he said that the bitcoin price volatility demonstrates that cryptocurrencies can be as much as 10 times more volatile than other core markets:

He also said that of particular importance is the impact on the portfolio’s risk-return characteristics “over the long term or during periods of extreme cyclical or political stress,” which might include a recession, sudden increase in inflation, crises involving currencies, and “collapse of the payments system.”

Proper diversification offers some protection against such events, but should bitcoin be included as an agent of portfolio diversification? In short, the JPMorgan analyst sees the potential for bitcoin to offer some level of value in terms of diversification for the medium term, but with “a few caveats.”

Normand noted that cryptocurrencies haven’t been around long enough to track their impacts over multiple business cycles. However, it is possible to draw some conclusions from what’s been going on with the bitcoin price over the last few years.

Leave A Comment