The yield curve collapse means nothing…

Don’t sweat it…

Video length: 00:00:20

While Trannies ripped higher, the rest of the equity market hummed along the unchanged line in a narrow range… (NOTE the weakness toward the end of the day which seems to have been catalkyzed by reports that Trump met with John Taylor re: fed head)

The S&P dipped to unchanged on the week…

The Russell 2000 has gone nowhere for 9 days (after ripping 12% higher in the prior month)… (1509, 1511, 1508, 1512, 1510, 1504, 1508, 1507, 1505)

The banks with earnings today both stumbled…

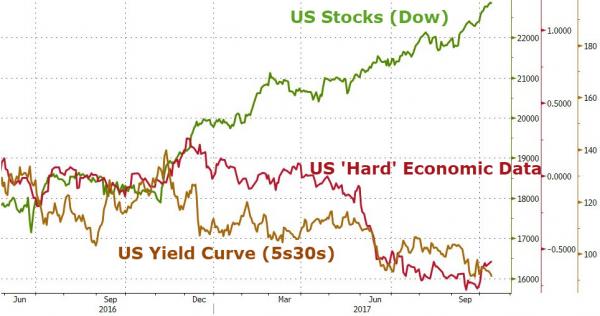

Financials underperformed as the yield curve kept collapsing since FOMC…

But Retailers rout was the worst on the day…

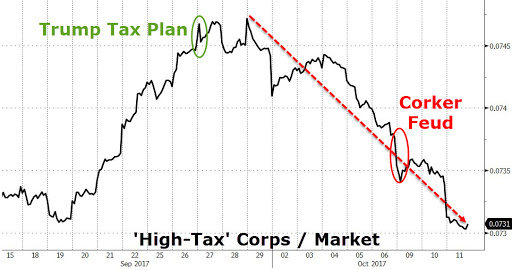

The Trump Tax trade continues to fade…

Treasury yields fell once again today… (strongest 30Y auction in 2 years)

And just like everything else, reversed their trend from China’s Golden Week…

But Copper’s recent relative strength to Gold prompts Gundlach’s favoite indicator to be uber bond bearish…

As we noted earlier, 5s30 has now collapsed to its flattest since the start of the last recession…

The Dollar Index reversed early gains to end unchanged as the post-Golden Week trend continues…

Cable has been the biggest driver of US weaknes this week though Yuan strength has also weighed…

Gold jumped overnight to $1299.80 before fading back on PPI before bouncing back higher after Europe closed…

Leave A Comment