Major discrepancies between rate hike odds have surfaced between Bloomberg and CME. Additional discrepancies within Bloomberg itself are also noticeable.

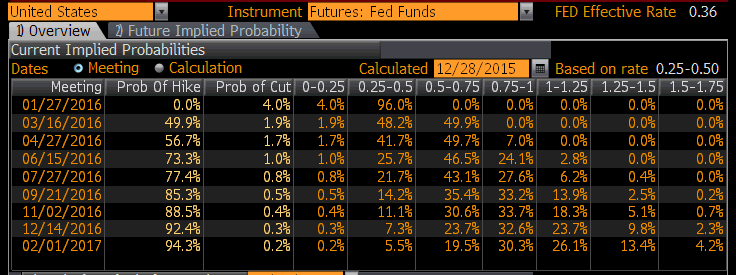

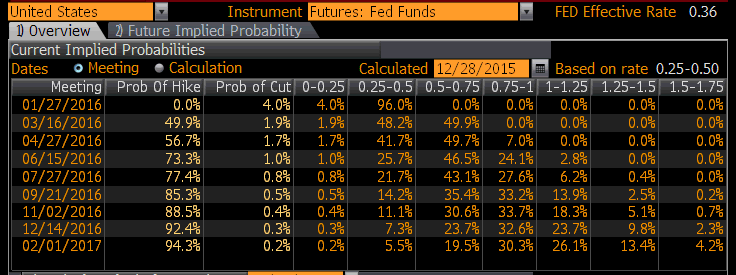

Let’s start with comparison of Bloomberg rate hike odds on 12/28/2015 vs. Bloomberg on 2/4/2016.

Bloomberg Rate Hike Odds 12/28/2015

On 12/28/2015 Bloomberg showed small chances of a rate cut at various meetings between then and the December meeting on 12/14/2016.

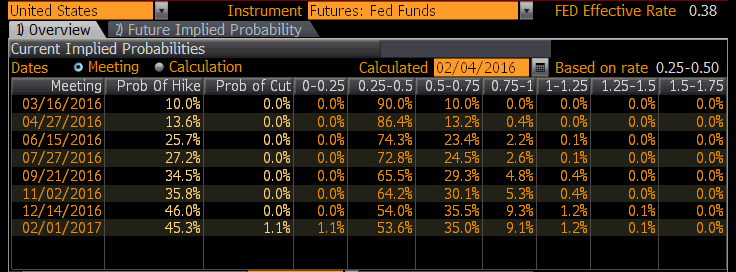

Then, despite reams of poor economic data, the chance of a rate cut for the rest of 2016 supposedly shrank to precisely 0% in a snapshot taken on February 4, 2016.

Bloomberg Rate Hike Odds 02/04/2015

After being 0% for all of 2016, odds of cut mysteriously jump to 1.1% for the February 2017 meeting. I don’t believe this is logically possible.

Thanks to reader “Randy” for the above snapshots.

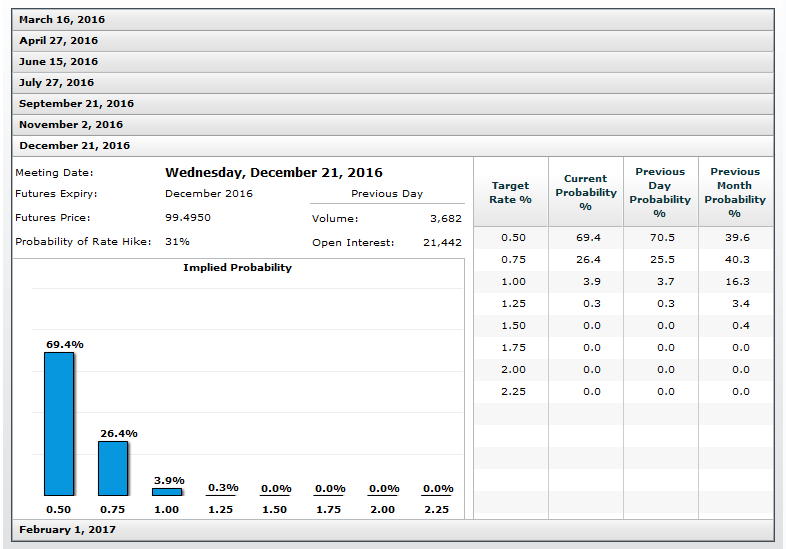

CME Rate Hike Odds December 2016

According to the FOMC Calendar, CME Fedwatch has the wrong meeting date for the December meeting.

Score a victory point for Bloomberg on getting the December meeting date correct. Give Bloomberg another point for at least mentioning the possibility of a cut, something CME fails to do.

CME vs. Bloomberg

Odds from Bloomberg and the CME were both captured on February 4, 2016.

Perhaps one organization is incorporating both futures and options and the other isn’t. Regardless, someone is wrong.

Actually, in light of discussion about negative rates and the increasing odds of rate cuts, both are wrong.

For further discussion of negative rates, please see Like Lemmings Over a Cliff: Fed to Test Negative Interest Rates.

Mike “Mish” Shedlock

Leave A Comment