In this article, I will review the latest economic reports and review some data on buybacks. The ADP private sector payrolls report came in better than expected, but there was a large negative revision in the February report. The ISM non-manufacturing report missed expectations. This could be sign the strong survey data trend is starting to crack. It’s too early to make that proclamation based on one weaker than expected report. The reason why I note this possibility is because the survey data will inevitably fall given the weakness seen in the hard data and the lack of a fiscal stimulus. The argument in favor of believing the survey data was that fiscal stimulus was going to prove the optimists correct. It’s still early in the president’s term, so it’s not surprising that nothing has gotten done. However, if a small business hired workers in December in the anticipation of strong demand provided by stimulus, the business will be feeling heat without any stimulus.

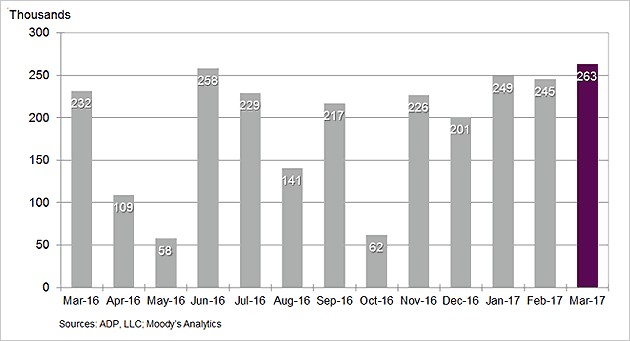

Going into the ADP report, I was expecting a strong report which showed some deceleration from February because of the slight weakness in the jobless claims data and the winter storm which hit the northeast in mid-March. From the information we had yesterday, this prediction was accurate because 263,000 jobs were created which was less than the 298,000 originally reported. However, February’s report was revised down to 245,000, so March’s report showed acceleration making it the best report in the past twelve months as you can see in the chart below.

The best summary of the ADP report is to say it was a blowout. It beat expectations for 170,000 jobs created. This great report is causing economists to increase their forecasts for the BLS report on Friday. This strong report makes me expect accelerated hourly earnings growth in the report on Friday. At this point in the cycle, even with the large slack in the labor market, we should be seeing pay raises to non-supervisory workers. The Fed wants to see an increase in hourly wages, but its response to that increase would be more hawkishness which will squash the bubble economy.

Leave A Comment