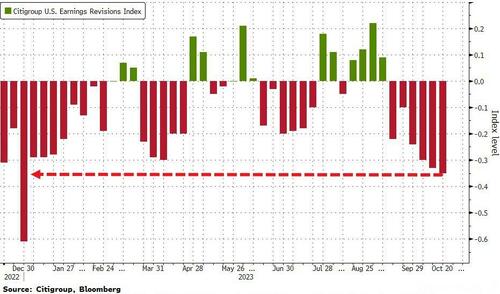

US Macro data surprised to the upside this week (seasonally-adjusted, of course), despite tightening financial conditions… Source: Bloomberg…but the US earnings outlook is deteriorating rapidly, as Barclays strategists say full-year guidance “looks unusually soft” for this time of year, while the number of profit warnings are already trending toward season-highs with about half of the S&P 500 still to report…

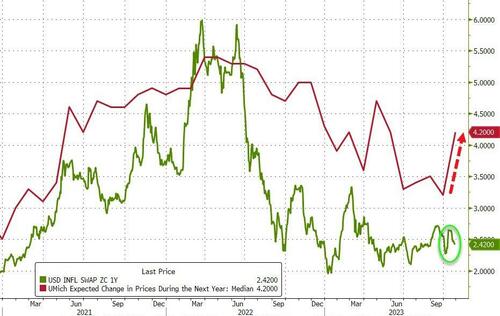

Source: Bloomberg…but the US earnings outlook is deteriorating rapidly, as Barclays strategists say full-year guidance “looks unusually soft” for this time of year, while the number of profit warnings are already trending toward season-highs with about half of the S&P 500 still to report… Source: Bloomberg…and while the market’s expectations for inflation over the next 12 months is lower this month, Americans’ expectations for inflation is dramatically rebounding…

Source: Bloomberg…and while the market’s expectations for inflation over the next 12 months is lower this month, Americans’ expectations for inflation is dramatically rebounding… Source: Bloomberg…and the term premium has soared to its highest since 2015…

Source: Bloomberg…and the term premium has soared to its highest since 2015… Source: BloombergAll of which makes one wonder, why all of a sudden UST yields are rising along with USA sovereign risk’s sudden surge…

Source: BloombergAll of which makes one wonder, why all of a sudden UST yields are rising along with USA sovereign risk’s sudden surge… Source: BloombergAround 1300ET, the IDF warned of an imminent ground invasion and several signals showed internet being cut off in Gaza. That sent stocks legging lower and gold and oil soaring…

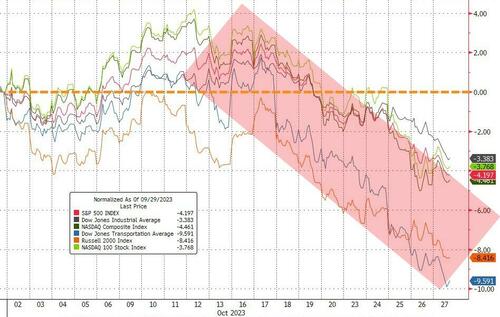

Source: BloombergAround 1300ET, the IDF warned of an imminent ground invasion and several signals showed internet being cut off in Gaza. That sent stocks legging lower and gold and oil soaring… The US majors were already at the lows of the day, and those losses accelerated on the Gaza headlines. The Dow was the marginal winner of the bunch, not puking quite as hard as the rest…

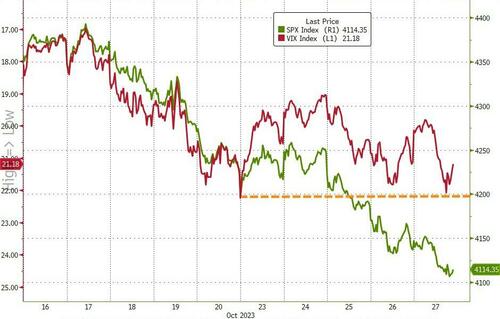

The US majors were already at the lows of the day, and those losses accelerated on the Gaza headlines. The Dow was the marginal winner of the bunch, not puking quite as hard as the rest… VIX actually ended lower on the week (by a smidge) and has decoupled from the drop in the S&P…

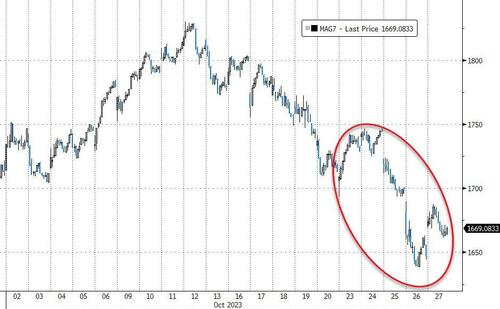

VIX actually ended lower on the week (by a smidge) and has decoupled from the drop in the S&P… Source: BloombergA really ugly week for big-tech with the Magnificent 7 tumbling to the lowest since May 2023 …

Source: BloombergA really ugly week for big-tech with the Magnificent 7 tumbling to the lowest since May 2023 … Source: Bloomberg…but the banks were battered too

Source: Bloomberg…but the banks were battered too S&P and Nasdaq entered correction making October an ugly month…

S&P and Nasdaq entered correction making October an ugly month… Source: BloombergThe equal-weighted S&P tumbled to one-year lows today and the cap-weighted S&P is starting to catch down to it fast…

Source: BloombergThe equal-weighted S&P tumbled to one-year lows today and the cap-weighted S&P is starting to catch down to it fast… Source: BloombergAmid all the chaos, Treasuries were actually relatively well-behaved today, holding yesterday’s gains with yields down between 5 and 10bps on the week (led by the belly)

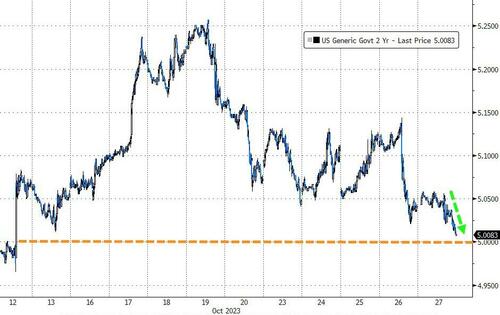

Source: BloombergAmid all the chaos, Treasuries were actually relatively well-behaved today, holding yesterday’s gains with yields down between 5 and 10bps on the week (led by the belly) Source: BloombergThe 2Y Yields fell back toward 5.00% (10Y broke below it and 30Y oscillated around it)…

Source: BloombergThe 2Y Yields fell back toward 5.00% (10Y broke below it and 30Y oscillated around it)… Source: BloombergThe yield curve (2s30s) uninverted…

Source: BloombergThe yield curve (2s30s) uninverted… Source: BloombergAmid all the crazy swings in stocks and commodities, the dollar ended the week very marginally higher…

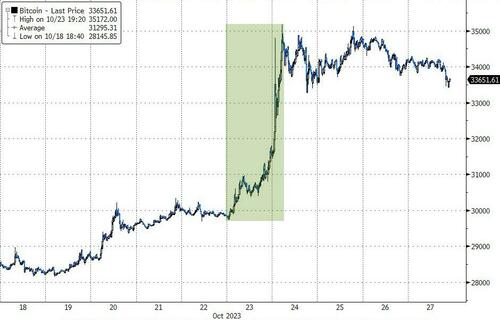

Source: BloombergAmid all the crazy swings in stocks and commodities, the dollar ended the week very marginally higher… Source: BloombergBitcoin surged midweek, topping $35,000 for the first time since May 2022, and held the gains

Source: BloombergBitcoin surged midweek, topping $35,000 for the first time since May 2022, and held the gains Source: BloombergOil dropped over 4% this week, but today’s escalation pushed WTI back up to $86…

Source: BloombergOil dropped over 4% this week, but today’s escalation pushed WTI back up to $86… Spot Gold surged on the Gaza headlines, topping $2000…

Spot Gold surged on the Gaza headlines, topping $2000… Source: Bloomberg…up to its highest since May (nearing record highs)…

Source: Bloomberg…up to its highest since May (nearing record highs)… Source: BloombergFinally, as Alasdair Macleod noted on America’s deteriorating finances: gold is now rising along with US Treasury yields…

Source: BloombergFinally, as Alasdair Macleod noted on America’s deteriorating finances: gold is now rising along with US Treasury yields… Source: Bloomberg…indicating that the dollar is becoming destabilised by Bidenomics, and a debt trap is being sprung on US Government finances.More By This Author:Gold Tops $2000 Amid Global Conflict, Govt ChaosFed Admits Banks Suffered Massive Deposit Outflows Last WeekGold Tops $2000 Amid Global Conflict, Govt Chaos

Source: Bloomberg…indicating that the dollar is becoming destabilised by Bidenomics, and a debt trap is being sprung on US Government finances.More By This Author:Gold Tops $2000 Amid Global Conflict, Govt ChaosFed Admits Banks Suffered Massive Deposit Outflows Last WeekGold Tops $2000 Amid Global Conflict, Govt Chaos

Leave A Comment