News headlines proclaimed a strange anomaly in the financial markets this week as both stocks and bonds fell together. Typically, when stocks crash, money moves into the bond market and other safe-haven assets to protect capital, but that’s not what we’ve seen since earlier this year.

Jim Bianco, founder of Bianco Research, says investors are switching from a deflationary to an inflationary mindset, similar to what we saw during the 1970s, and bonds may no longer provide a hedge against the stock market.

Here’s what he recently told Financial Sense Newshour (see Jim Bianco on Fed Killing the Recovery, Kavanaugh Political Aftermath for audio).

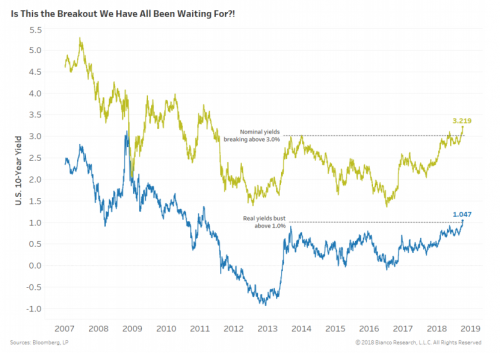

The Breakout We’ve All Been Waiting For

Early last week the 10-year yield broke above 3.11 and prior to our interview with Bianco, it had reached as high as 3.23. This is a seven-year high in the 10-year yield, Bianco noted.

What’s pushing the yield higher is a fear of inflation, and Bianco said that’s happening in one of two ways. Either as part of a combination of what economists call the Phillips Curve, in which strong growth is going to push inflation or, simply, inflation is finally returning after years of easy monetary policy.

Source: Bloomberg LP

Bianco asserted there’s one thing everyone’s missing with the fear of inflation returning—what this means for asset allocation models. There is a perception today that we still exist in a risk-on, risk-off environment, he added. In a risk-on scenario, investors assume that when stocks go up, bonds will go down, and vice versa.

The key, Bianco noted, is that the two asset classes move in opposite directions at the same time. This has led many mangers to recommend getting out of bonds, because as interest rates rise, bond prices will fall, meaning stocks should benefit in a risk-on, risk-off environment.

“We’ve been arguing that story ended this year, and that we’re now back to a more traditional 1970’s to 1990’s period where bonds and stocks go up and down at the same time,” Bianco said. “When rates broke out to new seven year highs, I’m not at all surprised that over the last two days the Dow has fallen 500 points. That’s because higher rates now bring up the idea that it might mean a return of inflation, and that is bad for stocks.”

Leave A Comment