Flush. Rinse. Repeat. BTFD!

Well, you could also give a good whack to the weak hands, burn the over-boughts, call in the sideline cash and get giddy about the fundur…mentals!

After all, the man on bubblevision said nothing has changed since the January 25 high at 2873 on the S&P 500. So there’s that: Another easy peasy 6% gain by just getting back to the trajectory of still another blowout year.

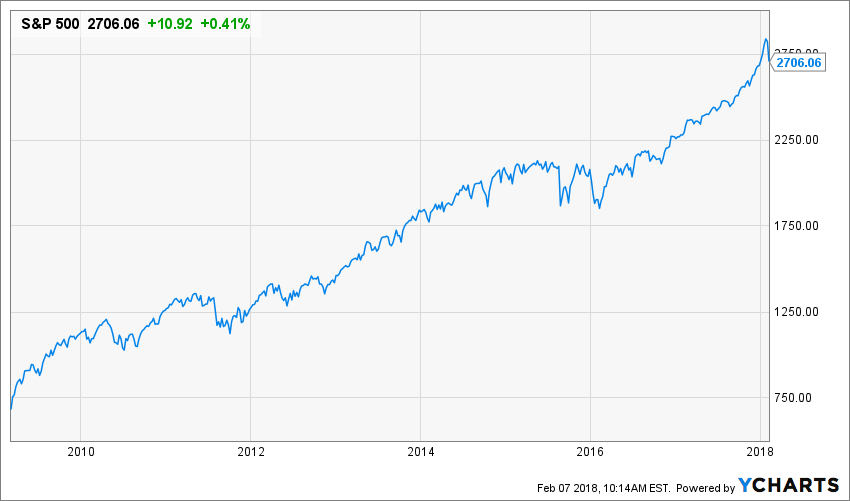

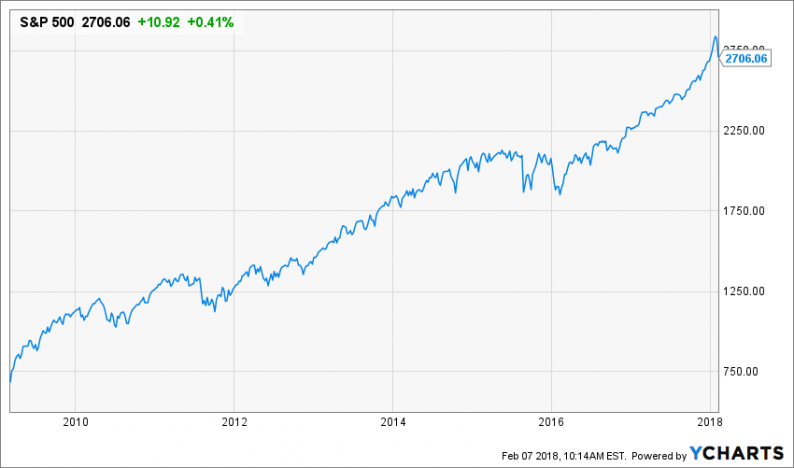

Moreover, having posted nine consecutive such years, one more doesn’t seem that hard to imagine, nor does another successful episode of buying the dip. The chart below documents dozens of that very thing since the March 2009 bottom.

Unfortunately, it also charts an alternate financial universe that is treading hard upon its sell-by date. That is, this is not the work of a capitalist free market in equity securities; it’s the consequence of a $14 trillion bond-buying spree by the Fed and other central banks since the financial crisis.

This tsunami of false liquidity and the accompanying price-keeping operations did drastically suppress interest rates and fuel rampant free-money carry trades. It also fostered the TINA (there is no alternative) trade in stocks and the investor scramble for yield into corporates and junk bonds, which, in turn, triggered massive corporate financial engineering maneuvers.

The latter flushed trillions of buying power into the Wall Street casino, even as it shrunk the supply of equities. Deeper in the casino, short sellers were executed, portfolio hedging became dirt cheap and various exotic forms of structured finance in options and volatility trades ramped the stock indices still higher.

At length, the financial markets and the main street economy became completely decoupled, and that is the true “fundamental” that has not changed in the last two weeks. It’s also the fundamental which guarantees that the Friday-Monday swoon was just a minor warm-up for the main event.

That’s because the economy is getting progressively weaker and longer in the tooth—-even as the central banks pivot away from the massive liquidity injections which inflated and sustained the financial bubble.

Indeed, whatever dip buying that remains will likely be shallow and short-lived. The peak level of central bank liquidity injection at a $2.1 trillion annual rate is already fast sinking toward the flat line, pulled down by the Fed ramping its bond dump-a-thon toward $600 billion per annum and the fast fading ECB’s bond-buying campaign as it glides toward the zero bound by October.

So the time is at hand to say good-bye to the chart below. Rather than climbing much further to the upper right, we think it is only a matter of time before involuntary cliff-diving becomes the order of the day.

The perma-bulls, of course, implicitly argue that someone or nother (they don’t say who or what) has abolished the business cycle, and that a never before midnight hour romp is about to hit the current aging recovery. When it comes to business cycle repeal, we’ll take the unders. But even then, it does seem pretty evident that the US economy is not about to get a shot of monetary Viagra from the Fed.

Leave A Comment