To be sure, we haven’t exactly been shy about characterizing Brazil’s economic malaise as more akin to a depression than a recession. Here are a few representative headlines:

The problem, you’re reminded, is that Brazil is in the midst of a dramatic economic downturn that’s left the country to suffer through the worst inflation-growth outcome (i.e. stagflation) in more than a decade. Unemployment and inflation are soaring (annual headline IPCA inflation at 10.28%, unemployment at 7.9% in August, up from just 4.7% a year earlier) while output is plunging (IBC-Br monthly real GDP indicator down 6.1% Y/Y in September) and the market is losing confidence in the government’s ability to end a political stalemate on the way to shoring up the fiscal books and hitting primary surplus targets. Last week’s arrest of prominent lawmaker Delcidio Amaral in connection with the ongoing Carwash investigation didn’t help.

Thanks to the above mentioned IBC-Br monthly indicator (which showed an economy in “free fall” to quote Barclays) we already knew Q3 was going to be bad on the GDP front. But this is Brazil we’re talking about, which means that as bad as consensus is, there’s always the distinct possibility that the actual numbers will be far worse than expected and that’s exactly what happened on Tuesday.

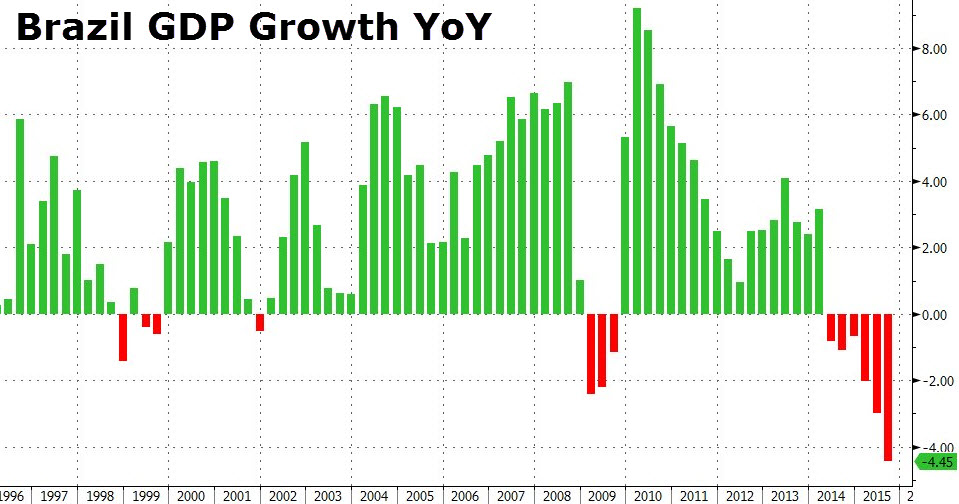

Real GDP fell 1.7% Q/Q and 4.5% Y/Y while Q2’s already abysmal -1.9% contraction was revised down to -2.1%.

All of those prints missed expectations and the headline number was worse than all but three estimates from the 44 economists Bloomberg surveyed.

If you dig down a bit further you can begin to see why we’ve been so adamant about calling this a depression. Here’s Goldman with the summary:

Leave A Comment